Newsletter

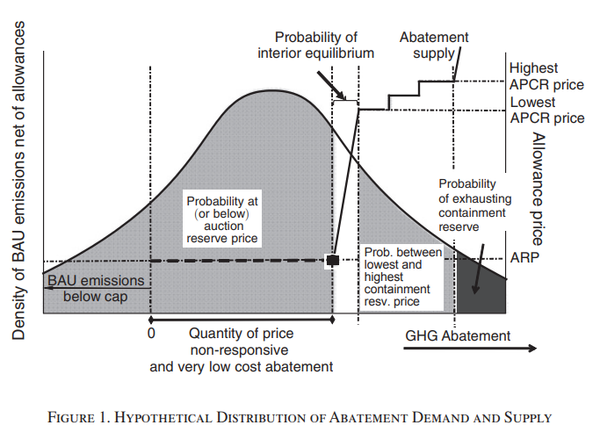

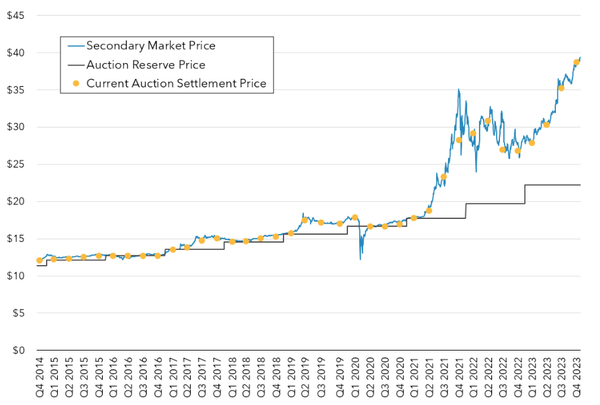

A carbon floor price is a bad idea

Meddling in markets built on trust is rarely successful.

Newsletter

Meddling in markets built on trust is rarely successful.

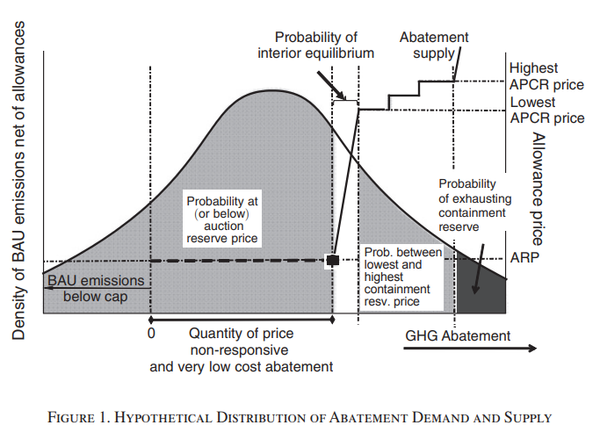

cbam

Cheap Russian coal, macroeconomic disarray, and the EU's carbon border levy

Newsletter

Welcome to Carbon Risk — helping investors navigate 'The Currency of Decarbonisation'! 🏭 If you haven’t already subscribed please click on the link below, or try a 7-day free trial giving you full access. By subscribing you’ll join more than 3,000 people who already read Carbon Risk.

Newsletter

Welcome to Carbon Risk — helping investors navigate 'The Currency of Decarbonisation'! 🏭 If you haven’t already subscribed please click on the link below, or try a 7-day free trial giving you full access. By subscribing you’ll join more than 3,000 people who already read Carbon Risk.

Newsletter

Welcome to Carbon Risk — helping investors navigate 'The Currency of Decarbonisation'! 🏭 If you haven’t already subscribed please click on the link below, or try a 7-day free trial giving you full access. By subscribing you’ll join more than 3,000 people who already read Carbon Risk.

Newsletter

Welcome to Carbon Risk — helping investors navigate 'The Currency of Decarbonisation'! If you haven’t already subscribed please click on the link below, or try a 7-day free trial giving you full access. Subscribe now By subscribing you’ll join more than 3,000 people who already read

Newsletter

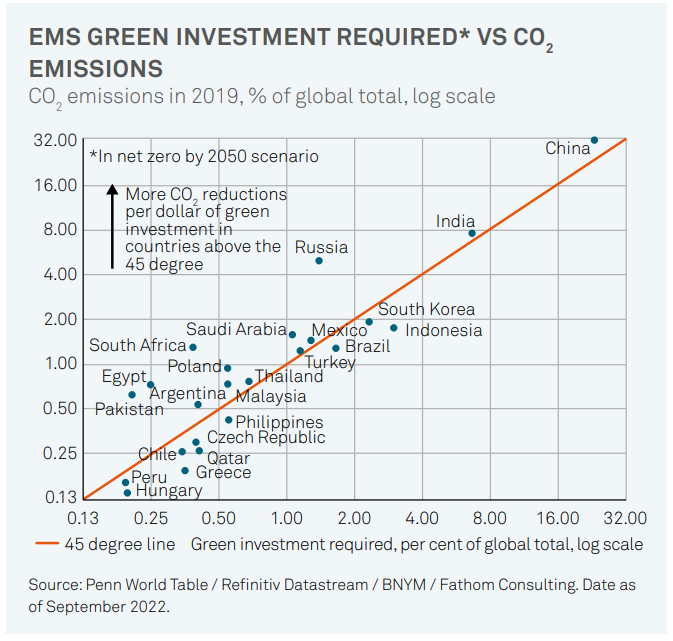

Country level emissions data are (probably) not what they seem

Newsletter

Welcome to Carbon Risk — helping investors navigate 'The Currency of Decarbonisation'! If you haven’t already subscribed please click on the link below, or try a 7-day free trial giving you full access. Subscribe now By subscribing you’ll join more than 3,000 people who already read

Newsletter

Welcome to Carbon Risk — helping investors navigate 'The Currency of Decarbonisation'! If you haven’t already subscribed please click on the link below, or try a 7-day free trial giving you full access. Subscribe now By subscribing you’ll join more than 3,000 people who already read

Newsletter

Welcome to Carbon Risk — helping investors navigate 'The Currency of Decarbonisation'! If you haven’t already subscribed please click on the link below, or try a 7-day free trial giving you full access. Subscribe now By subscribing you’ll join more than 3,000 people who already read

Newsletter

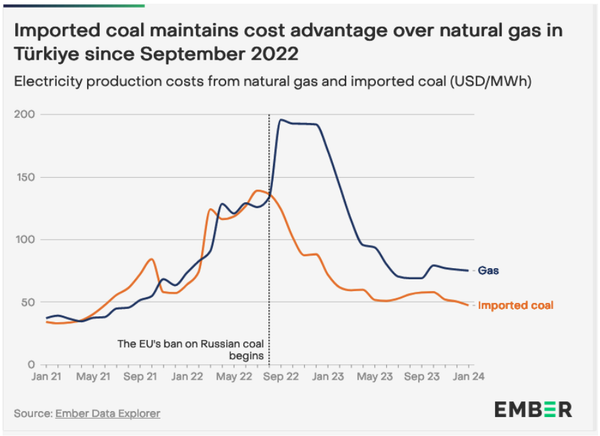

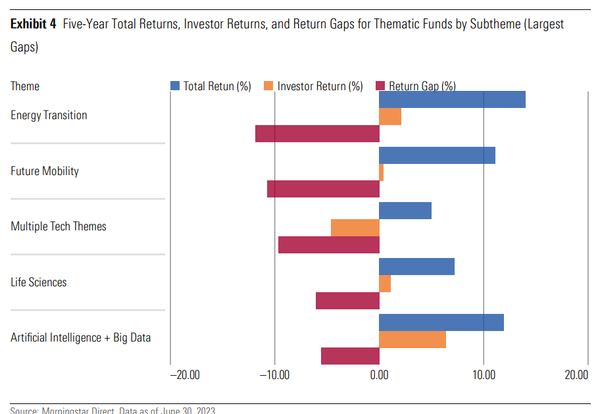

How to avoid losing money investing in the energy transition

Newsletter

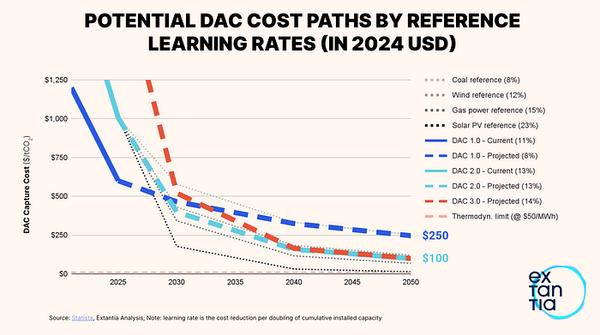

First shipment of liquefied CO2 could be a prelude to a global marketplace