Newsletter

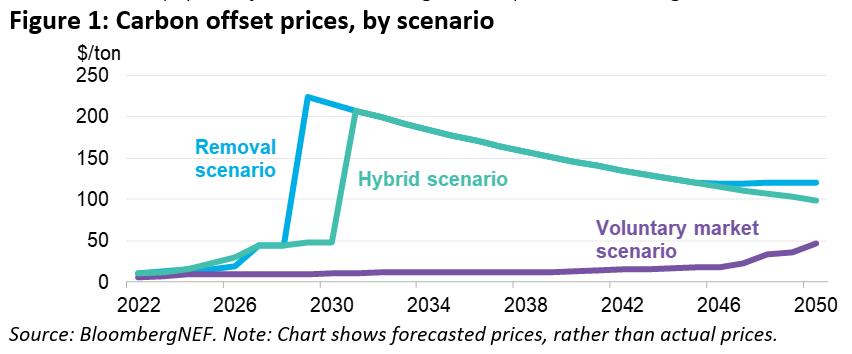

The emerging marginal buyer of carbon

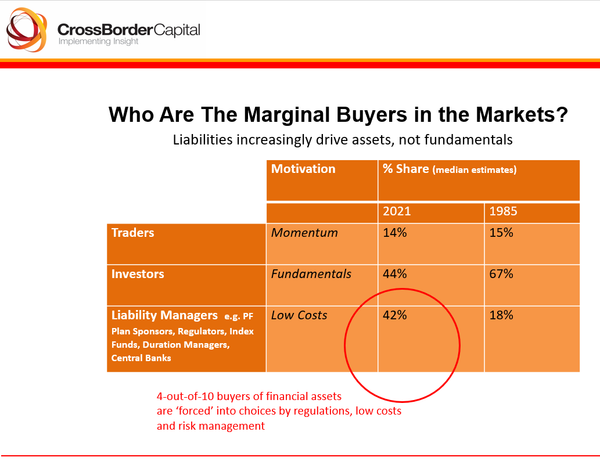

Carbon markets will gradually evolve to a state in which liabilities, and not fundamentals drive prices. To see how this could evolve you only need to look at the growth in investment products seeking to manage a specific liability for investors - whether that is retirement, risk management, ESG criteria,