Newsletter

In the shadows

Everything you need to know about internal carbon pricing

Newsletter

Everything you need to know about internal carbon pricing

Newsletter

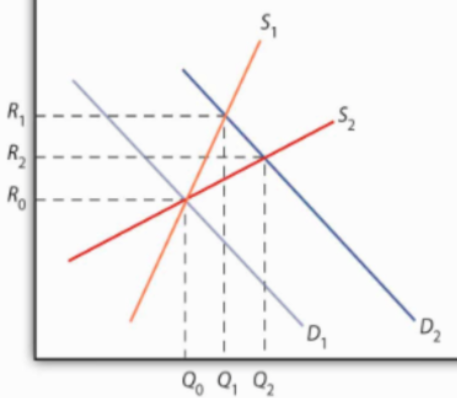

The UNFCCC Paris Agreement commits 196 countries to limit climate change to “well below 2°C” and establishes an aspiration of limiting warming to around 1.5°C. Assuming those countries most able to pay for emission reductions shoulder the burden then achieving the Paris Agreement implies that OECD and

Newsletter

How the next wave of speculation in its carbon market could play out

Newsletter

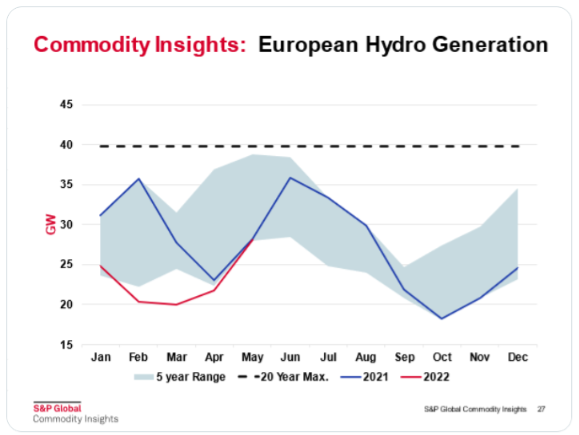

The risk of a severe and prolonged drought across much of Europe continues to rise. This is important for the EU carbon market because low reservoir levels mean less power can be generated from the continents hydroelectric dams. That means more power will need to come from the burning of

Newsletter

Focus on incentives to anticipate the next move in the EU carbon market

Newsletter

High commodity prices increase the incentive to clear forests and plant crops

Newsletter

How investors should think about the 'invisible fuel'

Newsletter

We are going to be hearing a lot more about Carbon Contract for Differences (CCfDs) over the next few months. As Europe looks to wean itself off Russian gas and accelerate its timetable for decarbonisation, CCfDs could be a powerful tool for unlocking investment in industrial decarbonisation, and in particular

Newsletter

Why forward guidance in the EU carbon market is here, and is set to stay

Newsletter

European industrial emissions (and demand for EUAs) have been supported by state protection against high energy prices

Newsletter

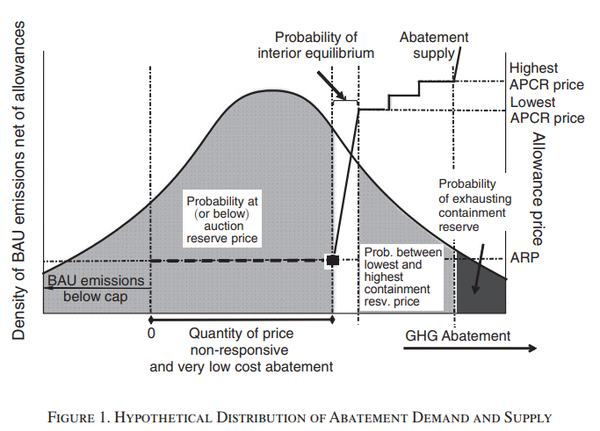

What California's mix of carbon policies means for price discovery

Newsletter

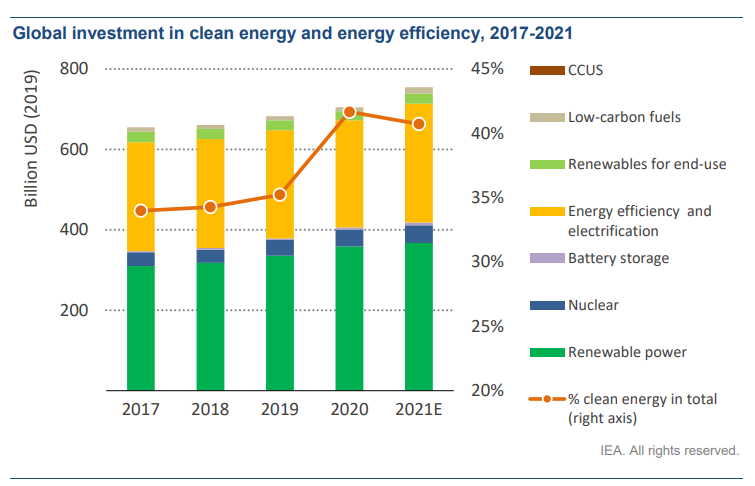

The EU must invest an extra €200bn over the next 5 years if it is to secure energy independence from Russia and accelerate the decarbonisation of the EU economy. That’s according to a leaked draft of the REpower EU package, due to be presented on Wednesday 18th May, and