Mixed signals

Last years crash in the New Zealand carbon price holds lessons for policymakers everywhere

Welcome to Carbon Risk — helping investors navigate 'The Currency of Decarbonisation'! 🏭.

“The ability to shape market expectations of future policy through public statements is one of the most powerful tools the Fed has. The downside for policymakers, of course, is that the cost of sending the wrong message can be high.” - Ben Bernanke, former chair of the Federal Reserve

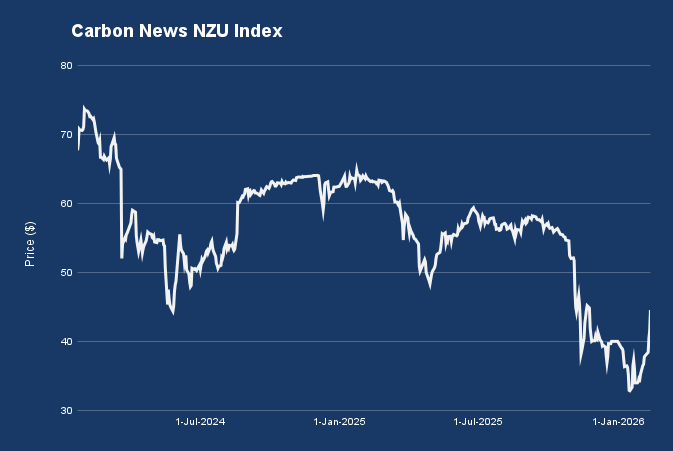

Back in November 2025 I reported that the price of carbon in New Zealand had slumped by more than NZ$10 to NZ$45 (~€23) after investors lost confidence in the governments climate policy commitments, leaving the market 50% down from the record high set three years earlier.

A drumbeat of negative policy announcements battered the resolve of market participants, forcing them to question the governments commitment to the New Zealand ETS and the value of the schemes emissions allowances, the NZU. As investors withdrew from the market in fright, liquidity collapsed exacerbating the sharp move lower:

- In early October the New Zealand government announced that in order to protect "agricultural competitiveness", it had decided to downgrade its 2050 biogenic methane emissions target from a 24-47 % reduction below 2017 levels to just 14-24 %. It was only a few years ago that the country was considered a leader in strong market-based methane abatement incentives.

- The government (potentially under the cosh from US officials) then abstained from voting at the International Maritime Organisation's (IMO) October meeting. Their failure to cast a vote - as well as that of several other governments - meant further delays to the planned global maritime carbon pricing mechanism.

- The minimum threshold for reporting under New Zealand's once world-leading climate disclosure regime would be raised to only cover companies with a market capitalisation of $1 billion or more, halving the number of firms accountable. It follows California and the EU in slashing corporate reporting demands.

- The knockout blow was a press statement signalling that the link between the cap trajectory and the New Zealand's Nationally Determined Contribution (NDC) would be severed, one of several announced changes to the Climate Change Response Act (2002). New Zealand was already estimated to fall short of its 2030 NDC by an entire years worth of emissions. The de-linking forced market participants to question the credibility of the ETS cap trajectory.

- Furthermore, the government announced that the Climate Change Commission - the independent body responsible for issuing climate policy advice, monitoring the governments progress, and generally adding much needed credibility - will "no longer be required to provide advice to the Government on emissions reduction plans."

New Zealand's fall from grace has not gone unnoticed abroad.

The latest edition of the Climate Change Performance Index (CCPI), an instrument to enable transparency in national and international climate politics, was published in November. It revealed that New Zealand had dropped 3 places to 44th, judging it to be a 'low performer' overall, and giving it a 'very low' score for climate policy following recent announcements. For context the United States is ranked 65th, only beating Iran and Saudi Arabia at the foot of the table.

Later in November, at the COP30 summit in Brazil, New Zealand was awarded the 'Fossil of the Day' award for its decision to weaken its methane emissions policies. The NGO Climate Action Network International hands out the dud award each day of COP to countries who are “doing the most to achieve the least” and "doing their best to be the worst" in terms of climate action and policy – it's the fourth time in five years that New Zealand has received the ignominious award.

Nevertheless, despite some of the headline grabbing negative climate policy announcements, there's reason to believe that the governments motives were misinterpreted. For example, the decision to sever the link between the ETS cap trajectory and the NDC was made because it really shouldn't been linked in the first place.

Finding 84 Mt CO2 in emission abatement by 2030 (one year of New Zealand's emissions) would have required buying huge amount of international credits (unlikely to be available in time), or dramatically slashing the availability of NZU's in the market, the latter resulting in an economically and politically harmful increase in the carbon price.

The market's swift reaction to the de-linking announcement is a harsh lesson that sensitive policy changes need to be managed much more effectively.

The rationale for severing the link was outlined in an accompanying regulatory statement. In it the Commission warns that “Meeting the first NDC with domestic action only would require a scale and pace of economic, social and technological change over the next five years that would be highly disruptive.”

Unfortunately it was buried on page 65 of the 242 page regulatory statement.

The NZ carbon market has rallied by as much as 25% in recent weeks as the government have tried to stem the negative sentiment and draw the markets attention back towards the medium to long-term targets. But at NZ$45 the price of an NZU has only now returned to the levels seen in the aftermath of the November crash.

Perhaps the most important market signal came from a recent letter between Climate Change Minister Simon Watts and the Commission in which the latter reaffirms the governments commitment to emissions reduction targets and the role of the carbon market:

"The Government is fully committed to meeting its emissions reduction targets, including the 2050 target, emissions budgets, and nationally determined contributions. The ETS plays a central role in achieving these targets, as set out in the Government’s Climate Strategy."

Watts concludes the letter by reiterating that the Commission has an important role to play, belatedly intending to bolster its credibility as an independent body:

"It would be helpful for the Government’s forthcoming ETS settings decision if the Commission’s advice provides options that explore the above considerations along with their implications and relative merits.

To avoid doubt: the Government has not made any decision as to the direction of ETS settings in 2026 at this stage. This additional advice will be a valuable input for the Government’s consideration when it forms a decision later this year."

Publishing the letter (alongside two other letters from the Commission) is an important act of market transparency, but it's debatable whether it's enough to re-establish the markets trust. Afterall, it takes time to establish trust, and no time at all for it to be broken. The market will want to see consistent and well thought out climate policies – not back of the envelope proposals leaked to the market without thought for how participants will react.

To that end the governments suggestion that the Commission explicitly consider measures that strengthen the market in a bid to contribute more to the 2030 NDC target (such as lower auction volumes and/or a higher auction floor prices) is an important step in re-establishing credibility.

The problem here is that there's very little that the ETS can do pre-2030 on volumes, except in an extreme scenario where the auctions are cancelled (very unlikely). Besides, even if the the Commission were to advise such a thing, the key credibility question will only be answered if and how the government acts on that advice.

The New Zealand government, as in many other countries, is being forced to face up to multiple threats: geopolitical and energy insecurity, industrial strategy and supply chain resilience, and the breakdown of global climate governance. Last week the government confirmed that it will seek to establish an LNG import facility by 2027/28.

Explaining the decision, Simon Watts (who also holds the title of Energy Minister) remarked that “New Zealand is experiencing a renewable electricity boom, but a rapidly declining gas supply has left our electricity sector exposed during dry years, when our hydro lakes run low...The result is greater reliance on coal and diesel, and ultimately higher electricity prices, putting more financial pressure on families and making businesses less competitive.”

The press release indicates that government will "design an import model that brings LNG in large shipments and only when needed, minimising exposure to international gas prices and keeping the door open for new technologies." However, many are fearful that the decision will lock New Zealand into dependence on imported LNG from America and do nothing to reduce the country's long-term exposure to volatile fossil fuel prices.

While the carbon market has rebounded to levels seen in mid-November, the prospects of a sustained recovery look mixed.

First, the government will be looking at the climate policy uncertainty over in Europe and questioning whether New Zealand really needs to have a high carbon price if the EU is seen as softening its own market. It's a topic that other countries who have signalled strong carbon market ambitions will no doubt be revisiting too.

Second, the National Party, the ruling party in the centre-right coalition government, recently announced that the next general election will be held on 7th November. As elsewhere in the world, voters in New Zealand are concerned about the cost of living and slow economic growth. If neither centre-left nor centre-right blocs secure an outright majority, coalition negotiations will add an extra bout of uncertainty and volatility into the carbon market.

Politicians and policymakers must now be Janus-like, amending energy and climate policies and introducing new ones with a view to satisfying multiple audiences and agendas at once. It's rather inevitable that, whether it be adjustments to the carbon market or the decision to build an LNG import facility, effective communication falls through the cracks.

As central bankers everywhere have learnt through experience, the cost of sending the wrong message can be high; a mistimed spike in interest rates deters investment and may cause equity markets to crash, while a slump in carbon prices reduces the incentive to invest in low-carbon technology.

Furthermore, as New Zealand has found to its cost, in an illiquid market the potential for huge swings in carbon prices is amplified, and this makes the investment case even worse. A 10% increase in carbon price volatility in the EU ETS for example has the same detrimental impact on investment in decarbonisation as a €12 per tonne decline in the carbon price.

The transition to a more 'pragmatic' carbon price mechanism, cognisant of energy security and industrial competitiveness concerns, will not be smooth. Politicians and climate policymakers have a big responsibility to ensure that any change in government priorities are clearly and effectively communicated to carbon market participants everywhere.

The German Chancellor, Friedrich Merz and other leaders will do well to remember that their words have consequences.