Newsletter

The green light from the Golden State

The California carbon market opportunity

Newsletter

The California carbon market opportunity

Newsletter

It’s difficult to imagine today, but at the beginning of the century commodities were not considered a true asset class. That began to change after the publication of a report from two academics, Gary Gorton and K. Geert Rouwenhorst. Their report, ‘Facts And Fantasies About Commodity Futures’ supported the

Newsletter

All commodity markets are political, you just need to understand the game that’s being played. Whether it is oil, sugar or rice or something else, government intervention isn’t too far away. Environmental markets such as carbon are a particular type of political construction in which artificial scarcity is

Newsletter

As the price of carbon rises it will increasingly imbed itself in the economy, becoming an important driver of costs for business, and ultimately prices for consumers. The economy (including all the products and services we consume) currently holds a massive uncovered short position on carbon. Nearly every material good

Newsletter

This week, Germany's new coalition government announced a series of climate and energy proposals that will guide their policies over the next four years. Notably, the agreement includes a proposal to “ideally” phase out coal by 2030, eight years earlier than previously committed. In order to achieve this

Newsletter

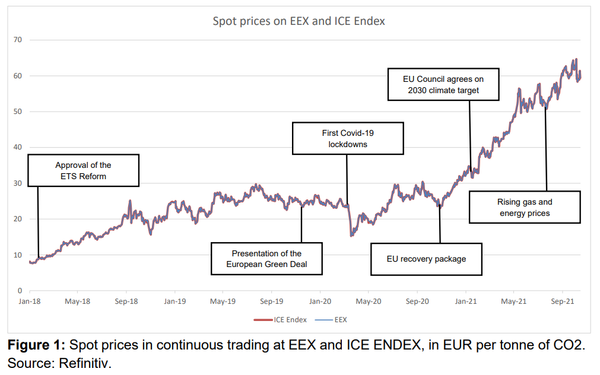

Last week the European Securities and Markets Authority (ESMA) published their preliminary report on the functioning of the EU carbon market. The report was requested by the European Commission in light of high energy prices in Europe, and subsequent questions that had emerged as to the functioning of its carbon

Newsletter

Getting to net zero means getting off zero. As of 2021, institutional investment in carbon markets is very low. That will need to change if the largest investors in the world want to hedge the biggest uncovered short position in their portfolio. Two factors that have limited the level of

Newsletter

How can investors make a credible, technology agnostic and profitable difference to climate change? Up until now the only way that investors felt they could make a difference to the environment was to divest their holdings from companies thought to be responsible for climate change. Divestment, as its known, might