Newsletter

VCM futures no refuge from equity market malaise

Strong corporate demand for carbon credits masks declining willingness to pay

Newsletter

Strong corporate demand for carbon credits masks declining willingness to pay

Newsletter

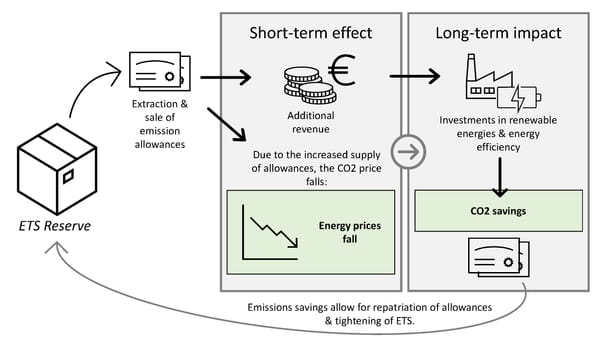

Calls grow for sale of emission allowances to fund Europe's energy transition

Newsletter

What happens when EU ETS emissions approach zero?

Newsletter

The Social Cost of Carbon (SCC) is an estimate of the net economic damage resulting from the addition of an incremental tonne of carbon dioxide (CO₂) into the atmosphere. The SCC is often used by policymakers when assessing the cost-benefit impact of climate related policies. For example, the SCC is

Newsletter

America's first nationwide price on a greenhouse gas does not go far enough

Newsletter

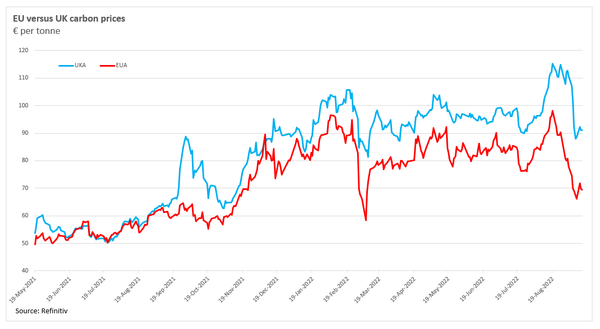

The UK carbon market is making a convincing case for being the strongest ‘Currency of Decarbonisation’. UK emission allocation (UKA) prices continue to trade over €90 per tonne, even despite experiencing a sharp sell-off in recent weeks.1 After hitting a daily settlement record of over €115 per tonne on

Newsletter

Energy molecules are moved by pipeline or tanker, from whence they came, to the point at which it is consumed. The modern global economy was built on this premise. Industrialisation led to greater demands on resources, which led to the exploitation of faraway fields, which helped fuel further development, which

Newsletter

The why, what and who you really need to know

Newsletter

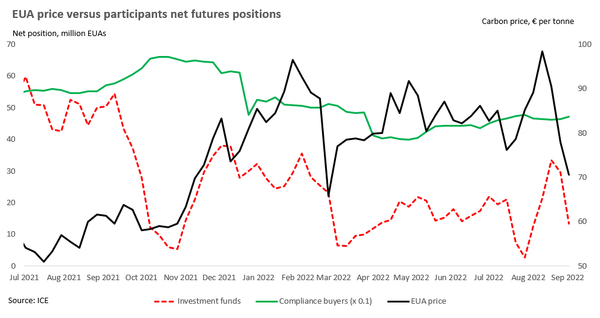

It’s often worth looking behind the scenes and trying to unpick how financial participants in the EU carbon market are behaving. Despite claims to the contrary, the actions of financial market participants are an important driver of carbon prices. In this article I review recent movements in carbon futures

Newsletter

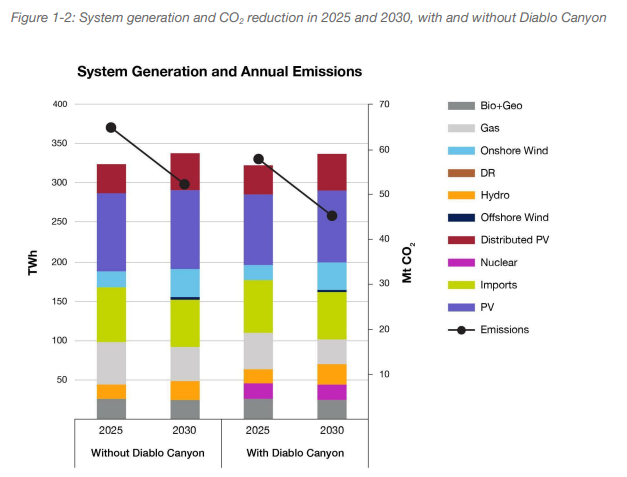

Not wanting to be outdone by Europe, a flurry of ‘bearish’ news hit the Californian carbon market during late August. Four factors are behind the recent change in sentiment: the extension of the Diablo Canyon nuclear facility (flagged previously on Carbon Risk as a risk here, here and here), the

Newsletter

How the EU carbon market is adapting to a long geopolitical winter

Newsletter

The EU carbon market is no stranger to volatile prices. Compared with other commodity markets EU carbon market volatility is broadly comparable with crude oil or coal, but tends to be significantly less volatile than natural gas (see The changing fortunes of the EU carbon market). Over the past four