Newsletter

How the other half cooks

Carbon credits with co-benefits

Newsletter

Carbon credits with co-benefits

Newsletter

“I think you’re going to see a very significant amount of money flow into natural capital as people figure out that nature is a very large proportion of the answer to decarbonisation. There is no route to net zero without biodiversity.” - Peter Harrison, chief executive of Schroders Forest,

Newsletter

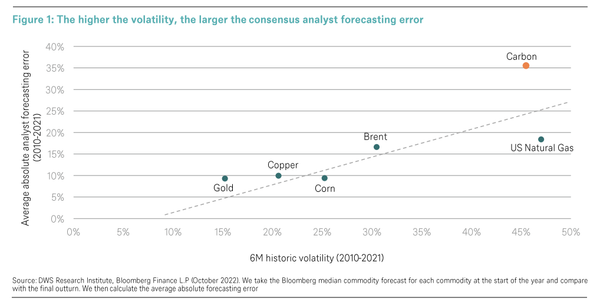

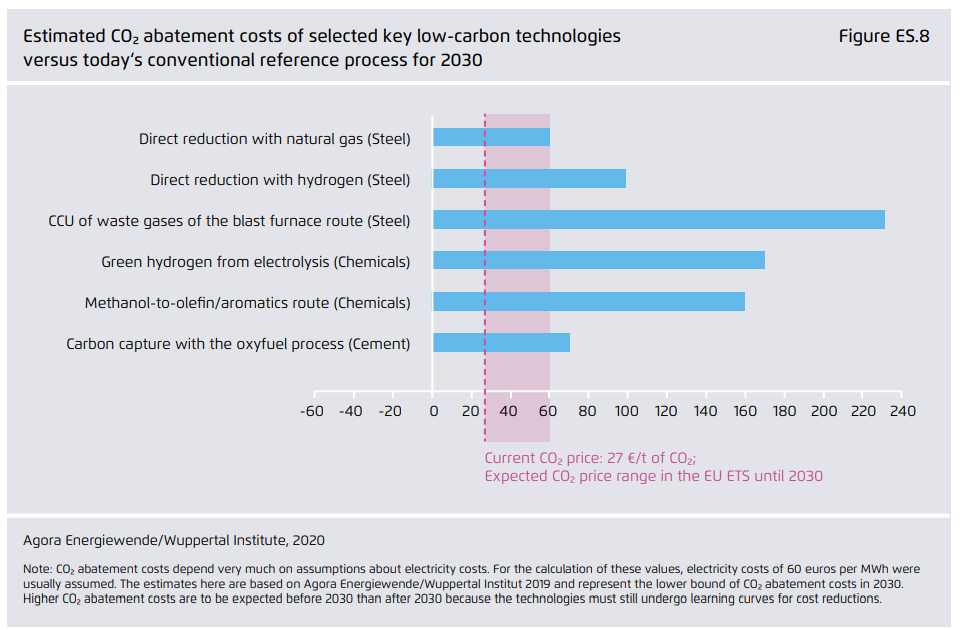

Power generators and major industrial emitters rely on carbon price forecasts to understand whether it is worth pursuing investments that could decarbonise their businesses. If carbon forecasts prove to be too high then investors may pay too high a price, bringing forward investments when other opportunities could have made better

Newsletter

What's behind the surge in EU carbon prices?

Newsletter

The United States will dominate global CCUS capacity

Newsletter

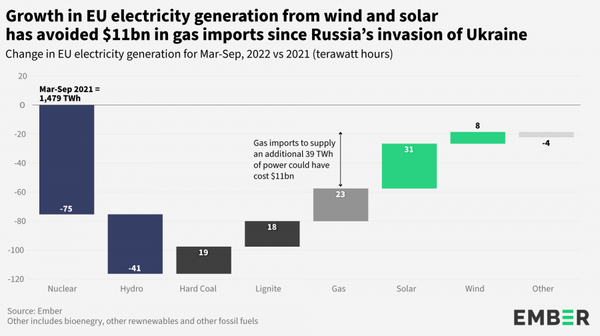

Nuclear generation tends to be uncorrelated with carbon prices. The exception is when high power prices coincide with a period of tight carbon allowance supply. This August’s surge in European power prices coincided with a sharp increase in EU carbon prices towards €100 per tonne as utilities looked to

Newsletter

Africa's "green superpower" expected to issue 90 million carbon credits

Newsletter

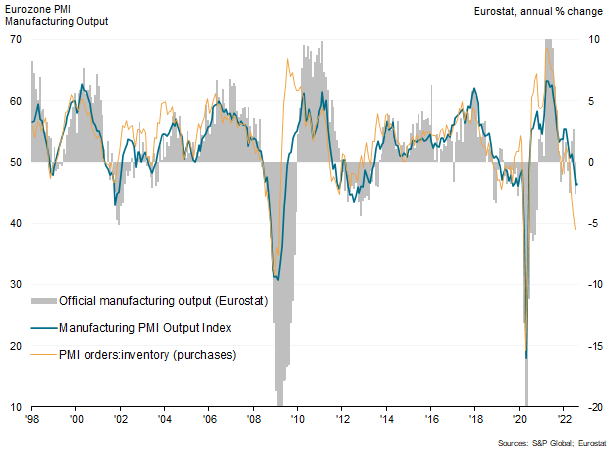

How bad will it get, and what does it mean for carbon?

Newsletter

The growth in electrolyser capacity is pivotal to Europe's decarbonisation ambitions

Newsletter

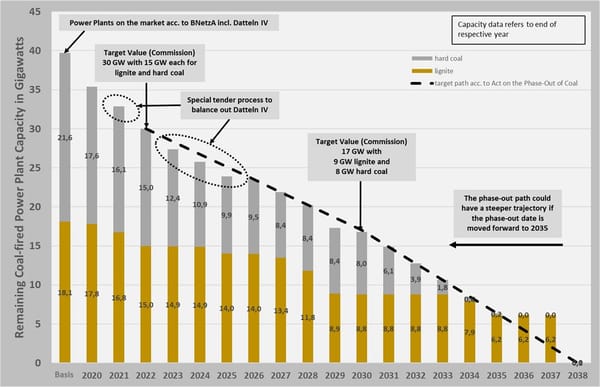

Last week German energy giant RWE announced that it will phase out the burning of coal by 2030, eight years earlier than agreed under Germany’s Coal Phase-Out-Act. The move to bring forward the phaseout means that ~280 million tonnes of CO2 will not now be emitted. The Act, passed

Newsletter

Gold miners have an image problem. The global metals and mining business is responsible for around 8% of global carbon emissions. In contrast to their compatriots mining copper, silver, tin, nickel and a whole host of other metals and minerals essential to driving the energy transition, gold miners have no

Newsletter

The case for technology-based carbon removal