No tree grows to heaven

EUAs caught in cross-commodity liquidation

What a week! The EU carbon market had been soldiering on serenely, making steady inroads towards €100, when all of a sudden more than three months of steady gains were wiped out within a few days. A classic up the escalator, and down the lift.

However, it would be wrong to say this was just a story about EUAs. No, the recent bout of volatility has exposed the increasing role that hedge funds play, not just in the EU carbon market, but now across the commodity sphere and how market dislocation in other often unrelated commodities, can unleash of wave of buying and selling pressure in EUAs.

Hedge funds assets under management rose above $5 trillion for the first time in 2025, according to Hedge Fund Research Inc with investors pumping in a net $116 billion last year, the most since 2007. While equities and fixed income have been the main source of trading activity in recent years, funds have recently sought to diversify their returns by taking a look at commodities. Indeed, last year the industry recorded its best annual performance since the depths of the Great Financial Crisis, in part supported by trend-following strategies tied to the precious metal boom and the spill-over into other metal markets.

Hedge funds have a long tradition of trading commodities dating at least back to the Chinese demand driven commodity super-cycle of the early 2000's. As I've discussed previously on Carbon Risk, speculators are often vilified when prices are perceived to have moved too high, too fast. Nevertheless, without speculators active in the market, liquidity levels would be much lower, resulting in even higher price volatility (see Know your onions: Concern over the role of speculators in Europe's energy markets is overplayed).

Meanwhile, hedge funds have the capital and the foresight to see through current market conditions and identify future bottlenecks. For energy, metals, and agricultural commodities, high prices are a signal that demand and supply need to adjust. For the EU carbon market high prices provides the incentive to bring forward investment in decarbonisation.

But you can always have too much of a good thing. Everything in moderation as they say. If everyone piles into the same strategy then the likelihood of an orderly exit should the narrative change is dramatically reduced. When someone shouts 'Fire' in a crowded theatre, you want to make damn sure you are near the exits.

In mid-December the FT reported that hedge funds were piling into physical commodities in search of fresh returns, despite as the paper noted, "lacking the decades of experience and information accumulated by established players such as Trafigura and Vitol." While oil and natural gas price volatility has been low as these markets returned to pre-energy crisis levels, commodity trading houses have looked to other physical commodity markets from which they can develop an informational advantage and utilise their huge balance sheets to eke out extra returns.

Multi-strategy hedge funds without an established presence in commodities have also seen the space as a way to diversify returns, ploughing into calendar spread options as a way to benefit from the volatility associated with the AI datacentre build-out, geopolitical turmoil and trade wars, and the impact of extreme weather on agricultural commodities. In December Bloomberg reported that Point72 Asset Management was considering following other multi-strategy funds such as Citadel, Balyasny Asset Management and Millennium Management into commodities.

EUAs have also been caught in the fund driven search for extra returns. As reported by Carbon Risk, the net long position in EUA futures and the ratio of long to short positions has soared to record highs. Only last week the FT reported that hedge funds were also piling into the EU carbon market, betting that the EUA supply squeeze will push prices higher; the number of hedge funds active in the market has surged in the last few month, rising from a long-term average of ~400 to almost 600 in January.

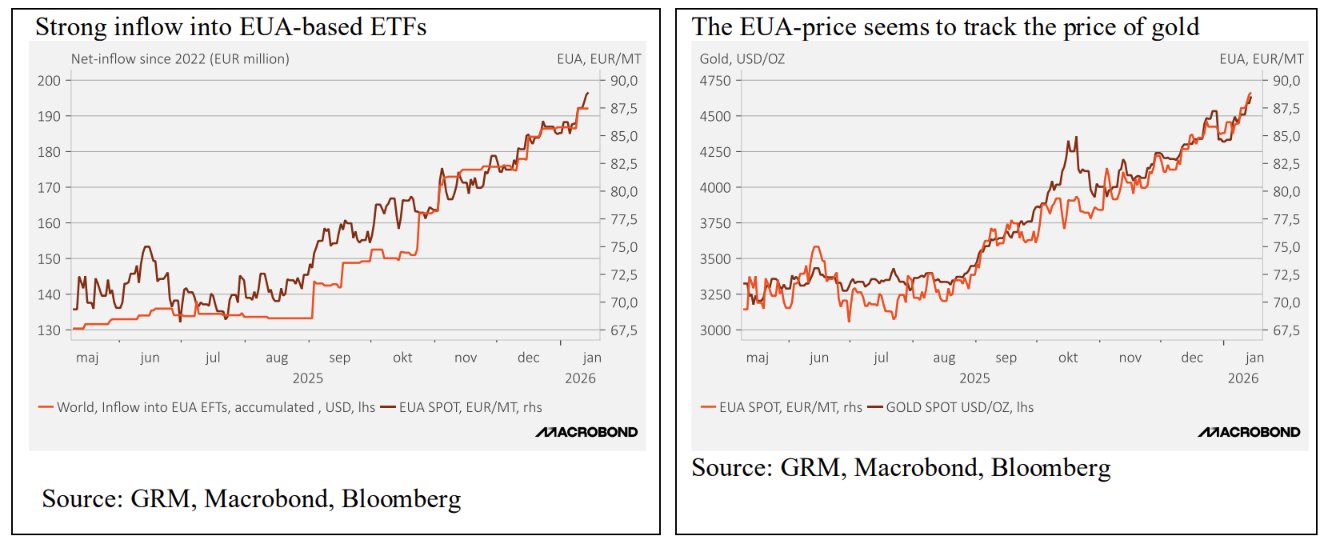

In a sign of the increasing correlation across commodity markets, Global Risk Management (GRM) pondered whether EUAs were now the new gold, noting that "it appears that EUAs have increasingly taken on the role of a safe-haven asset that investors buy as a substitute for gold." Sharing some of the characteristics as gold, GRM note that EUAs are characterised by declining annual supply, the lack of a coupon, and finally, strong credit quality as EU guarantees the system, if not the price. Retail investors have followed hedge funds and gradually increased their allocation to EUA-based ETF's as the price of carbon and gold soared.

The past couple weeks have seen extreme levels of market positioning and the associated narrative with analysts pondering whether even more extreme price moves are on the cards across a range of commodities.

The price of gold, silver and the PGM's had soared as strong demand hit an illiquid market constrained by tight supply. Geopolitical uncertainty including President Trump's continued threats towards Greenland, his lack of support for a strong dollar, as well as domestic disturbance in Minneapolis, all contributed to the narrative that the world is going to hell in a handbasket. The so-called debasement trade was on full tilt.

Other metals including copper, lithium and others also soared, buoyed by optimism that the data centre build out and rebuilding the electricity grid will push these markets into a deep deficit. The narrative that the rupture in the world order has produced a bifurcated commodity market, one where resource security trumps resource efficiency gripped the market.

In contrast to the bullish picture in metals, energy markets have been in a deep bear market. Crude oil and natural gas prices were pushed deeper into the red as the crude oil surplus swelled and expectations of a surge in LNG supply emboldened traders to increase their net short positions, betting that energy prices would continue to decline.

But then some began to get cold feet, while others shouted 'Fire'! Perhaps a good idea had been taken too far, by too many. A nagging feeling that market positioning had got too extended and now the risk reward favoured a switch in the prevailing narrative.

First, the imminent arrival of sub-zero temperatures forced US natural gas traders to revaluate their short positions, algorithmic trading strategies scrambling to close out, forcing a short squeeze that saw the price of natural gas soar by 140% prior to the contract expiry last week. The price of European natural gas had already started to recover in advance, but events in America then prompted what Energy Flux describes as the "biggest TTF short squeeze in CoT history," forcing TTF above €40 per MWh for the first time since the summer.

Meanwhile, metal markets were also facing their nadir. Whether the initial spark was the appointment of a new Fed chair or some nefarious precious metals deal in China gone wrong is irrelevant. A crowded momentum trade thinning on liquidity as prices soared was always going to see some speculators get crushed at the exits. And so it was to be with silver plunging by ~40%, gold ~20%, and other metals didn't escape the carnage. A big clue that this particular trade had gone too far came from the BBC, which often rings the bell at market extremes.

Commodities and other associated markets became a crowded trade. The problem is that once speculators are getting margin called in one market, the desperation to close out positions in other commodity markets can become overwhelming. In turn this propagates the volatility from one market to another even if there is no fundamental relationship between the two, other than as we've seen with EUAs and gold, market participants have adopted a similar market narrative of price action driven by scarcity.

The first major EUA bull market saw carbon prices jump more than 3-fold in a little over 14 months, from ~€23 in October 2020 to €90 in December 2021. No tree grows to heaven, at least in a straight line; the period was punctuated by at least three 10%+ corrections along the way. The latest correction in the EU carbon price is a wake up call for asset managers and other speculators expecting the forthcoming deficit in EUAs to be an easy ride to €100 and beyond.

Where do we go from here? Well, hopefully asset managers will have come to their senses and realise that commodities are not all one big trade such as that observed in the early 2000's when Chinese demand turned every commodity into gold. It's more likely that we're in a world where commodity markets swing from one bull market to another, and in-depth knowledge and insights will give funds an edge.

In short, the latest turmoil may have burned the tourists, and given them pause to develop a more sophisticated, fundamentally driven strategy. It may take a while to unwind the froth, but if and when that happens it will uncover some bargains for the more discerning long-term investor – and one of them will be EUAs.