Looking through it

Climate policy trade-offs complicate the outlook for eurozone monetary policy

“Central banks, in turn, will have to assess whether the green transition poses risks to price stability and to which extent deviations from their inflation target due to a rise in the contribution from energy to headline inflation are tolerable and consistent with their price stability mandates.” - European Central Bank economist Isabel Schnabel, speaking in 2022

While Europe's politicians argue over scrapping the 2035 ban on new internal combustion engine (ICE) cars and whether to allow international carbon credits to meet the 2040 emission targets, a nearer-term source of potential political risk is a new carbon pricing mechanism called ETS2. From 2027 onwards it will cover emissions from fuels used in building and transport, responsible for more than one-third of the European Unions emissions.

Earlier this year I published an article warning that the ETS2 price could rapidly breach €100 per tonne CO2. Although allowances from 2029-2031 are being front-loaded for the period up to May 2028, the low cap level relative to emissions, and the strong linear reduction factor (5.38% per year from 2028) means that a sustained and growing deficit is likely to occur by 2030 (see ETS2 carbon price could rapidly breach €100: Europe's second carbon market is expected to be very sensitive to emission allowance scarcity).

The lack of surplus ETS2 allowances on the market means the carbon price could push higher very quickly, perhaps even well beyond that necessary to abate emissions from heating or transportation. The latest projections from Veyt put the ETS2 price at around €85 per tonne CO2 in 2027 (broadly inline with initial trading in the Dec-28 ETS2 futures contract), surging to €147 per tonne CO2 in 2030, and then rising to €211 per tonne CO2 in 2034.

Last week, Carbon Pulse report that a draft letter addressed to European Commission President Ursula von der Leyen, and backed by several EU countries, calls for the "targeted postponement" of ETS2, "at least until 2030." It follows an earlier joint warning, issued by 16 predominantly eastern European member states in June, warning that ETS2 could impose heavy costs on communities and risk a public backlash, unless improvements are introduced that address concerns about price uncertainty and high prices.

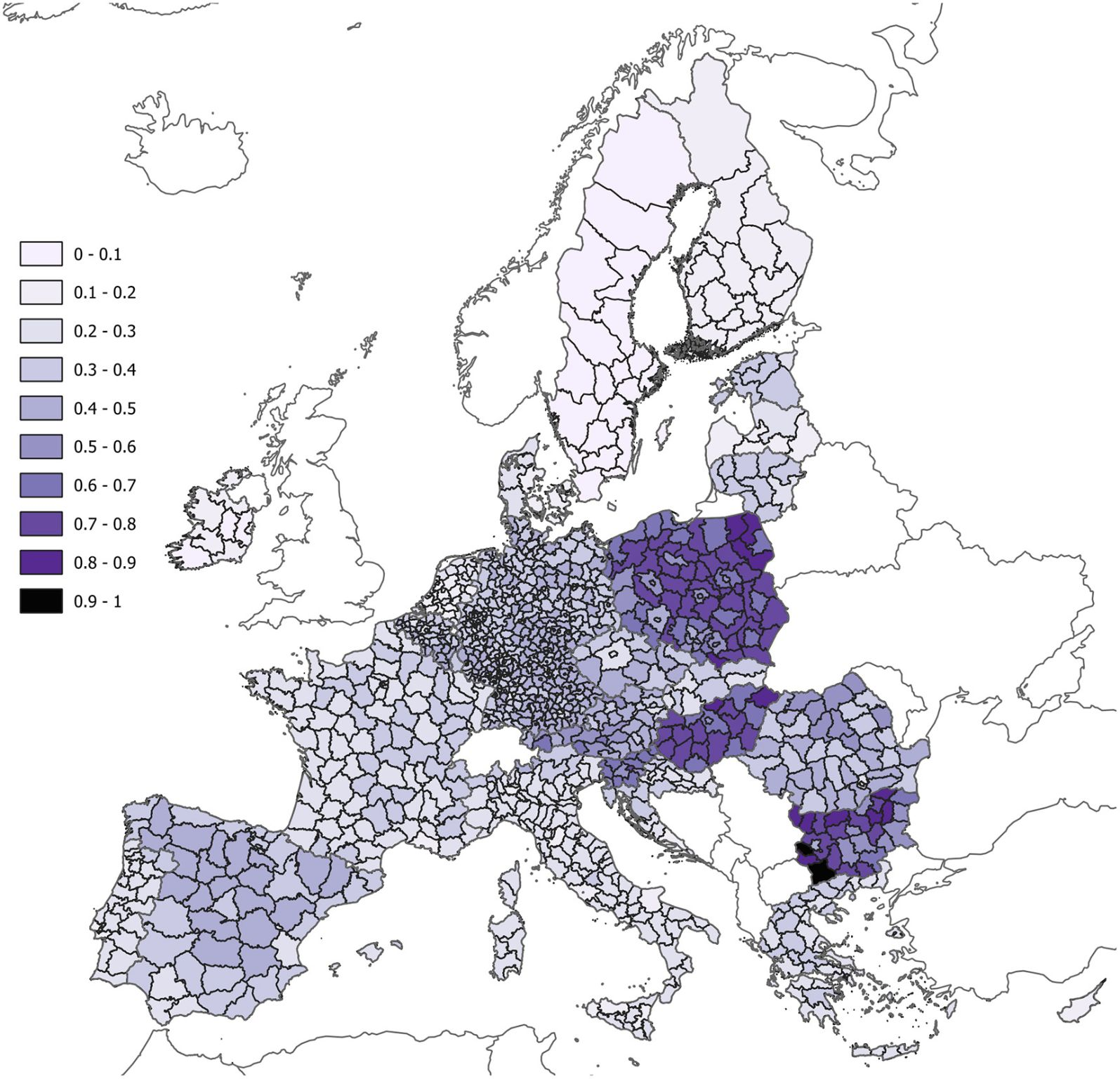

A recent study published in the Energy Policy journal shines a light on the regional inequality of ETS2 and why their governments have reason to worry. The researchers examined the distributional impacts of a $100 per tonne CO2 price on household heating and transportation spending across 1,160 regions of the EU. The strongest negative impacts are observed in low-GDP regions in central and eastern Europe, especially Poland, Bulgaria, Hungary, and Slovenia.

Rural households reliant on fossil fuels for heating (such as Poland where burning coal for heating is commonplace), and those with limited low-carbon infrastructure (for example, Bulgaria where there is limited rural public transportation) face a disproportionately high burden; 0.3 to 31 times higher than their urban counterparts (see Europe must learn from Canada's 'price on pollution' debacle).

It's no wonder the policy has got the attention of governments in eastern Europe, but as we'll see, any attempt to delay or add flexibility to ETS2 has important implications beyond climate policy. The potential impact on energy prices is fast becoming an important factor determining the eurozone's monetary policy too.

Read the rest of this article with a 30-day free trial*

*and get access to the entire archive!