Europe's new joule order

Europe imports more than half of the energy it needs, making it vulnerable to geopolitical and economic coercion – whether by friend or foe.

Europe's precarious position could get even worse if it fails to act. If the EU fulfils all of its signed LNG supply deals and fail to tackle demand for gas then according to the Institute for Energy Economics and Financial Analysis (IEEFA), 80% of the blocs total LNG imports could come from the US by 2030, up from 57% in 2025.

The increased security threat is likely to accelerate Europe's push towards renewable energy. For if trade is under threat, then so is the trade in fossil fuels. In contrast, because renewable energy is non-traded and essentially local, its value increases when security concerns are paramount.

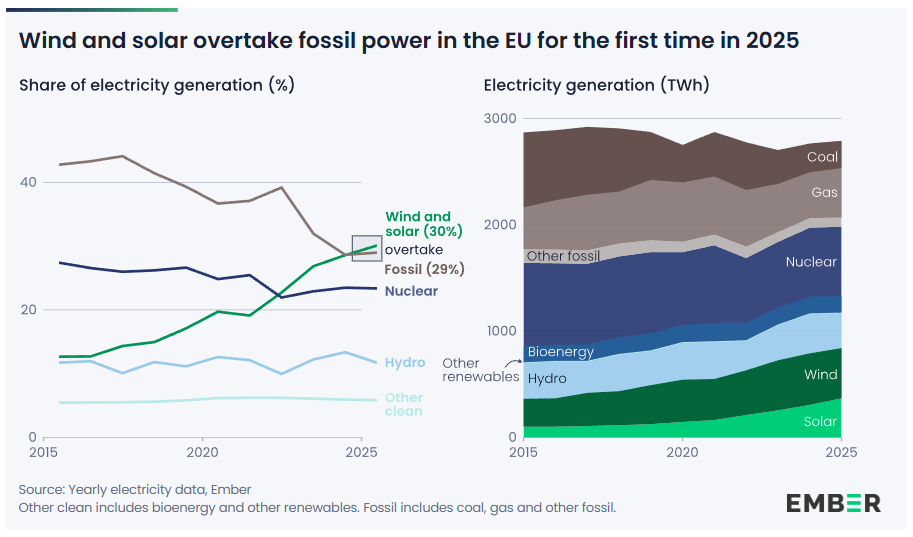

2025 was an historical turning point for the EU's power system. Wind and solar accounted for 30% of the blocs power generation, according to data from Ember, overtaking the 29% generated by burning fossil fuels for the first time. More than half of EU member states (14) saw wind and solar generate more electricity than fossil fuels.

Europe now has around 285 GW of wind power capacity (248 GW onshore and 37 GW offshore) according to industry association Wind Europe. Offshore wind generation is the focus for future growth given the vast potential to create a North Sea renewable and industrial powerhouse. Nevertheless, despite the ambitious targets the growth in offshore wind capacity has slowed to just 2.4 GW per annum over the past five years, versus 14.2 GW per annum for onshore wind.

A myriad of problems has contributed to the slow rate of annual offshore wind additions, including: the slow pace of electrification, grid bottlenecks, limited port and vessel capacity, permitting delays, rising costs (supply chain pressures, increased steel prices, and higher interest rates), and poorly designed auctions in several countries.

Read the rest of this article with a 30-day free trial*

*and get access to the entire archive!