Committed traders

"Calling someone who trades actively in the market an investor 'is like calling someone who repeatedly engages in one-night stands a romantic.'" — Warren Buffett

Committed traders? Surely an oxymoron on a par with 'passive investment' and 'deafening silence'. The resolution to this apparent contradiction is about to be played out in the EU carbon market.

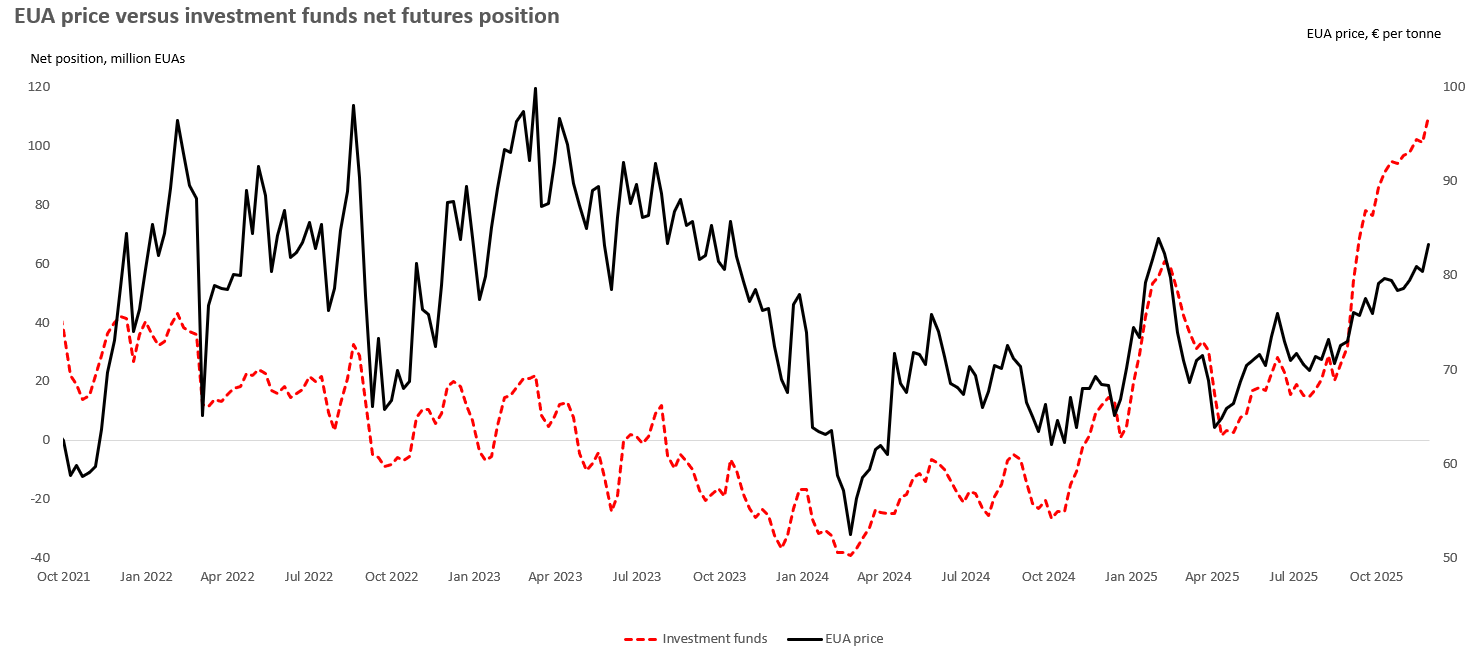

The latest Commitment of Traders (COT) report (w/e 28th November) shows that investment funds now sit on a net long position of 109.8 million EUAs, up more than 40% since I published All in: Investment funds race to stack EUA futures as price breakout looms on 2nd October.

After gorging on EUA futures and adding net length in size for three consecutive weeks during September (+10-20 million EUAs per week), the pace slowed in early October (+3 million EUAs per week). However, the latest data shows that funds have regained their appetite, adding an additional 9 million EUAs in w/e 28th November alone to hit yet another record net long position.

The Dec-25 EUA futures contract has risen by about €6 during the past two months to around €82 currently, an increase of about 8%. Not bad considering, but its nowhere near commensurate with the record build-up in net length and is something of an outlier historically.

What it does indicate is that funds with a large long position on their balance sheet are happy to hold (and even add to their positions at opportune moments), betting that the structural deficit in EUAs (supply is expected to decline by 21% in 2026 alone) will be enough to drive prices even higher into 2026.

Read the rest of this article with a 30-day free trial*

*and get access to the entire archive!