Cap and fade, or golden opportunity?

It's crunch time for California's cap-and-trade program

Welcome to Carbon Risk — helping investors navigate 'The Currency of Decarbonisation'! 🏭.

If you want to know more about how carbon markets combat climate change, what this burgeoning market means for investors, and the latest trends affecting decarbonisation then please consider upgrading your subscription.

Estimated reading time ~ 5 mins

It has been a tumultuous 12-18 months for California’s cap-and-trade program.

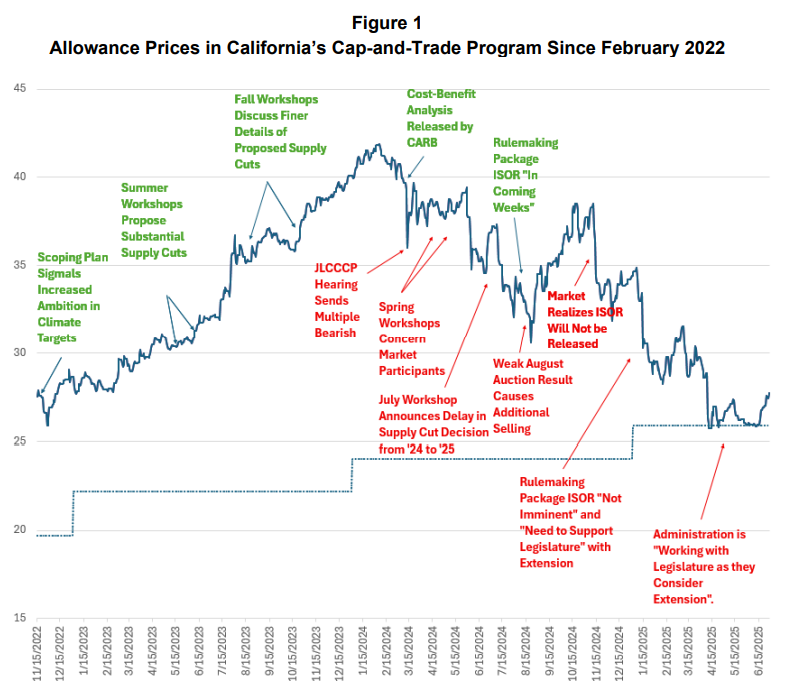

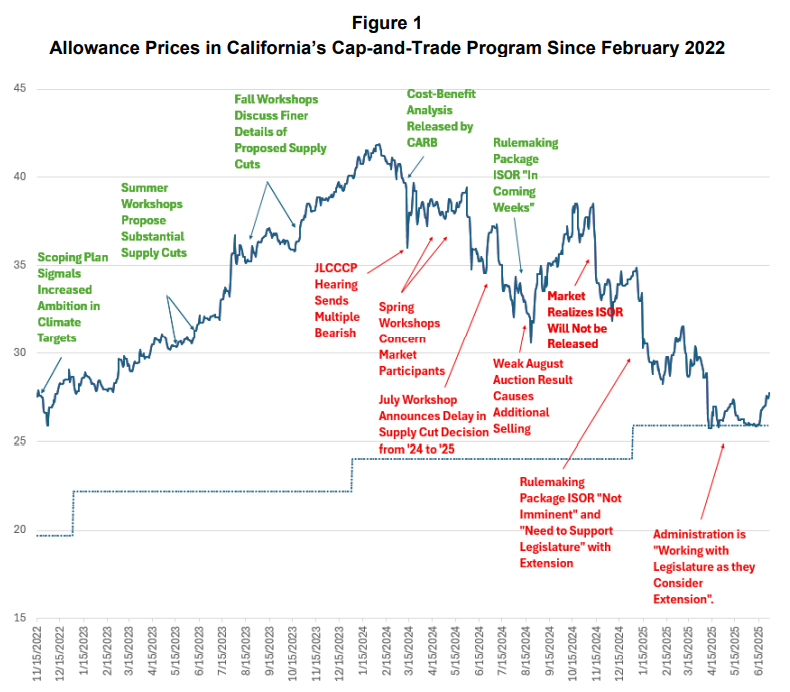

To recap, the Californian Carbon Allowance (CCA) price hit an all-time high of $41.91 per tonne CO2 in early 2024 as the market anticipated that reforms would result in substantial cuts to future supply. However, delayed rulemaking and uncertainty over the schemes future beyond 2030 sent the CCA price down to $26 per tonne, close to the auction floor price (see here and here).

More recently, California’s carbon market has been under siege from President Trump. In early April 2025 he issued an executive order blocking the enforcement of state laws that reduce the consumption of fossil fuels. Other cap-and-trade programs not beset by regulatory uncertainty, such as RGGI and Washington State, have seen the price of their emission allowances rise, suggesting that delayed reforms and the debate surrounding the reauthorisation are the main price drivers in California (see America's state carbon markets are under siege).

The regulatory befuddlement has not been without cost. The state of California has missed out on nearly $3 billion in revenue from its carbon market due to the tumbling carbon price since February 2024, according to a new report by non-profit Clean & Prosperous California. The missing revenue could have been used to lower household energy bills, help local communities adapt to climate change, reduce the barriers people face switching to lower carbon technologies, or indeed plug some of the states ballooning budget gap.1

In early April, Governor Newsom signalled his intention to extend authorisation for the cap-and-trade program through to 2045. However, it was his proposal for how future revenue will be spent, published one month later in mid-May, that got the attention of lawmakers. The decision to reauthorise the program beyond 2030 is now on hold pending a debate on how future revenues should be spent.2