Newsletter

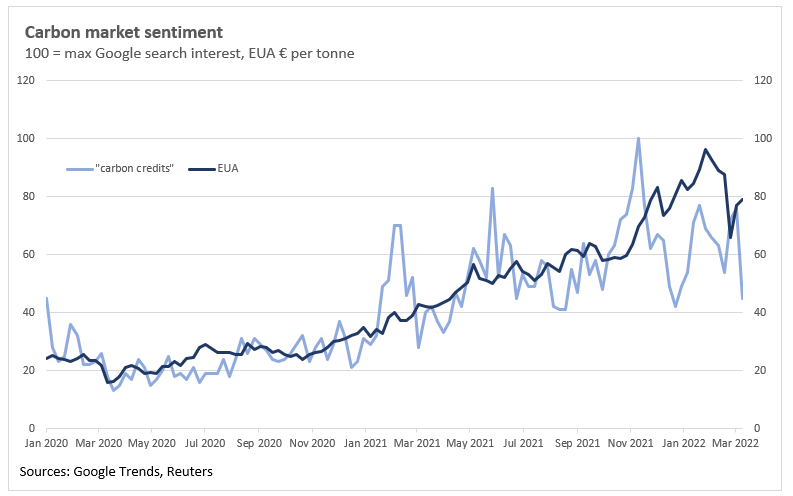

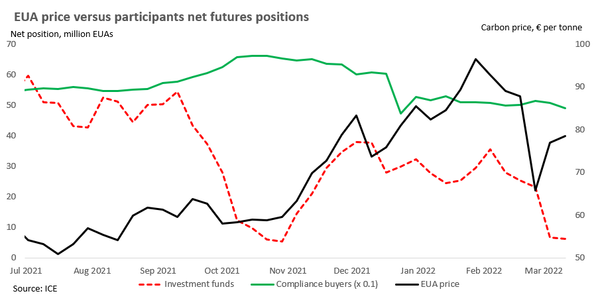

Are investment funds buying the rebound in carbon?

“If everyone is thinking the same thing, someone is not thinking.” - General George Patton, U.S. Army Futures markets are not simply full of speculators trying to anticipate what other speculators are going to do, although it might feel like that sometimes. Commodity futures markets involve a vast array