Newsletter

Carbon farming puts a value on dirt

Soil carbon sequestration is the next frontier of the carbon market

Newsletter

Soil carbon sequestration is the next frontier of the carbon market

Newsletter

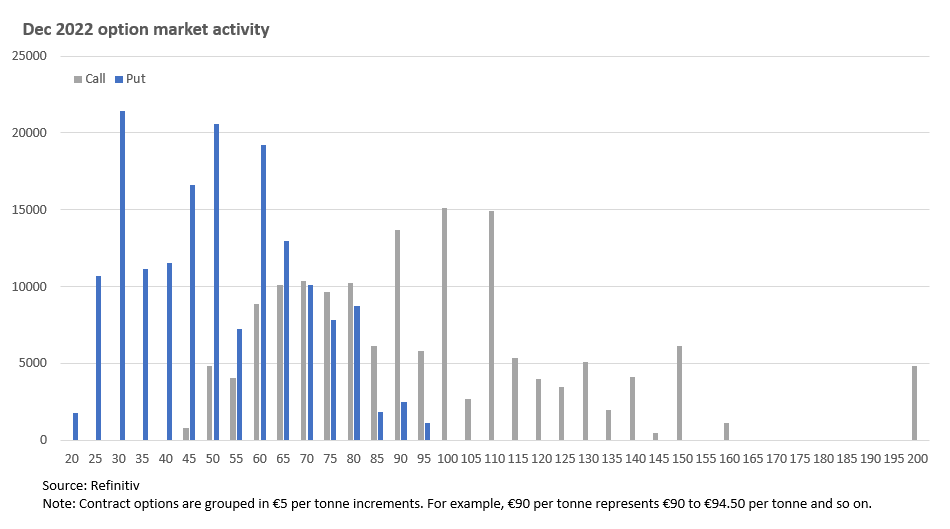

Over the past couple of weeks EU carbon prices have dropped 17%, from almost €95 per tonne in mid-December to around €76-€78 per tonne currently. The decline accelerated as the price broke through a number of key technical indicators: first the 23 and 30 day exponential moving averages, followed

Newsletter

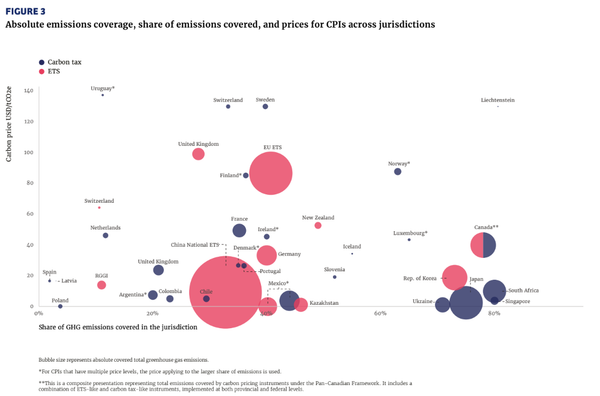

How patchy global carbon markets channel fossil fuel finance

Newsletter

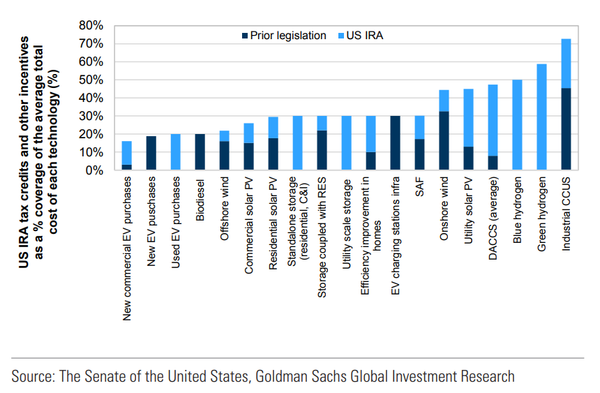

Why governments are looking to secure their green industrial sovereignty

Newsletter

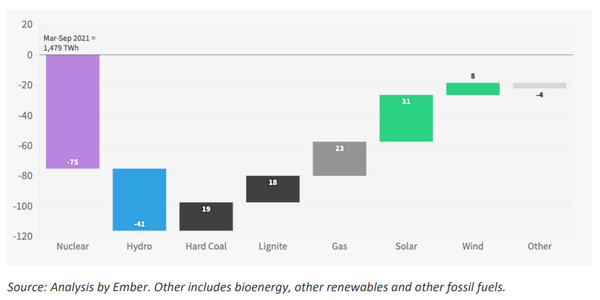

Europe's solar power does not get the credit it deserves

Newsletter

What the cleantech boom and bust tells us about the future of climate tech

Newsletter

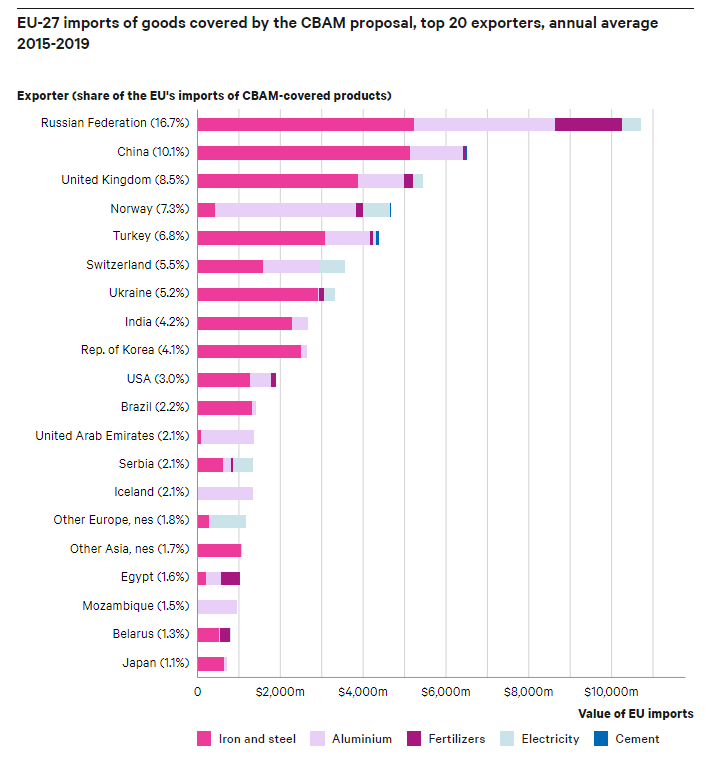

Europe's carbon levy will accelerate adoption of carbon pricing, but not everyone will win

Newsletter

Vanguard’s sudden exit from the Net Zero Asset Managers (NZAM) initiative appears to be behind a sharp drop in the price of carbon credit futures. The Nature-Based Global Emissions Offset (N-GEO) futures contract fell to an all-time low of close to $3 per tonne on Wednesday, down some 40%

Newsletter

The second state-wide carbon trading scheme in the United States is scheduled to start on 1st January 2023. California was the first state-wide carbon trading scheme, launched in 2013 it covers ~85% of the states emissions. Although the Regional Greenhouse Gas Initiative (RGGI) was the first emissions trading scheme in

Newsletter

The maritime sector is beginning to price in EU carbon prices

Newsletter

What chance a repeat of the late 2021 EUA price surge?

Newsletter

How the winter doldrums, wind "droughts", and "global stilling" affect power generation and the demand for carbon