Newsletter

The arc of carbon’s curve

What does the carbon futures curve tell us and why is it important?

Newsletter

What does the carbon futures curve tell us and why is it important?

Newsletter

The European airline industry is about to become much more exposed to developments in the EU carbon price. Up until now airlines have been cushioned from the full impact of meeting compliance; policymakers wary of ‘carbon leakage’, global disagreements over the cost, and state support for national champions have all

Newsletter

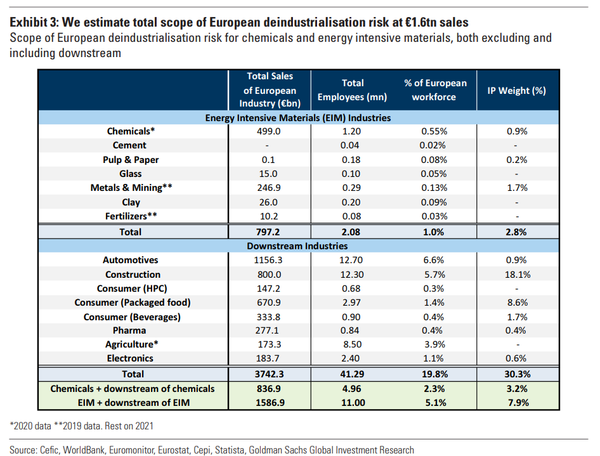

European chemicals behemoth BASF is one of Germany’s largest consumers of natural gas and has been particularly hard hit by the surge in energy prices following Russia’s invasion of Ukraine. In September 2022 the company announced that it was going to introduce a €500 million annual cost saving

Newsletter

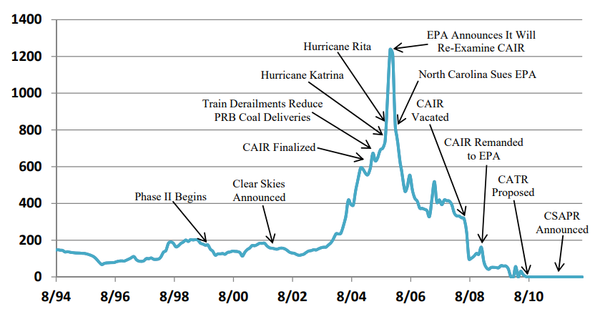

What lessons can we learn from the first cap-and-trade system?

Newsletter

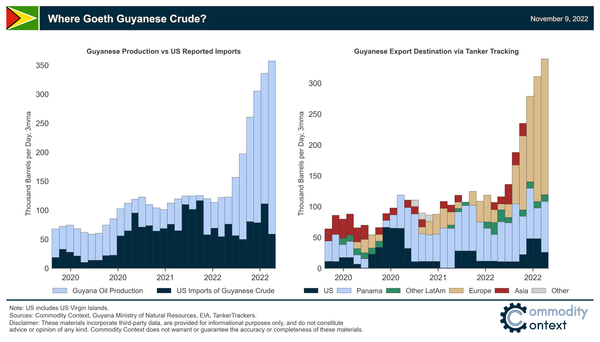

Guyana's huge bet on a carbon and oil constrained future

Newsletter

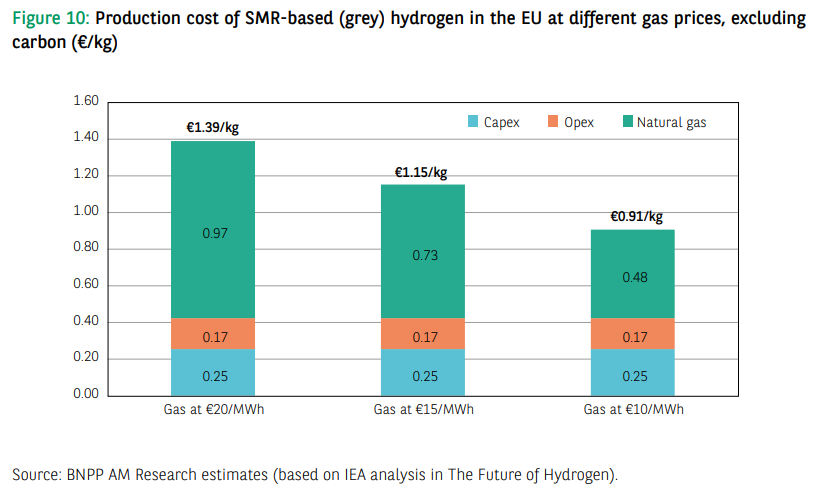

Biomethane could play a big role in European decarbonisation

Newsletter

In early February I reposted an article from the Carbon Risk archives, one that I felt which many current Carbon Risk readers probably haven’t seen before, but is arguably even more relevant now than the day that I posted it. Following that theme, today’s repost focuses on one

Newsletter

In mid-January UK newspaper The Guardian and German weekly magazine Die Zeit published the results of an investigation into rainforest carbon abatement credits, jointly carried out with SourceMaterial, a non-profit journalism organisation focused on investigating climate change, corruption and democracy. The researchers analysed the performance of REDD+ credits issued by

Newsletter

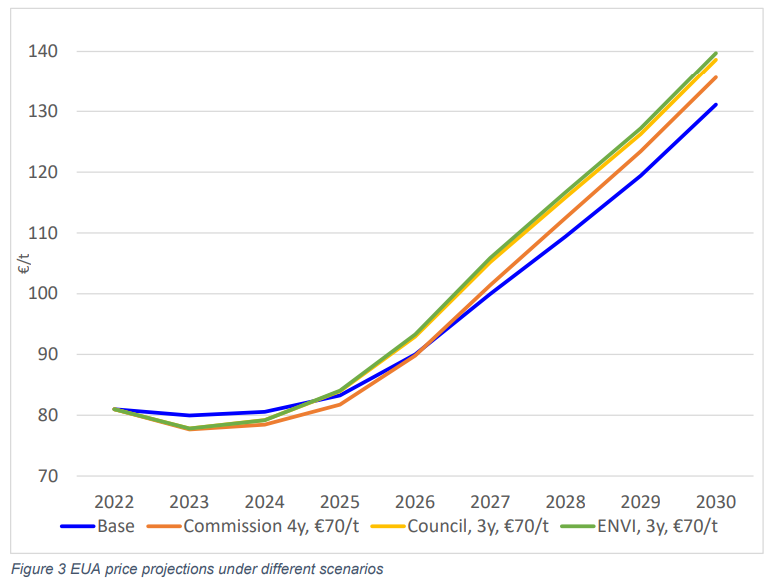

What can the EU do to stop carbon prices surging over €100?

Newsletter

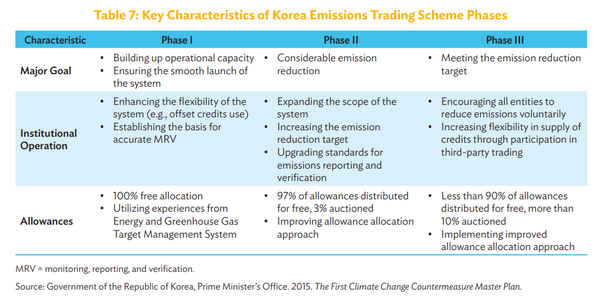

All compliance carbon markets seem to go through the same growing pains. The South Korean Emissions Trading Scheme (KETS) is no different. That being said, the Korean government face a unique set of challenges. In particular, legacy issues surrounding the country’s past support for industry, and the fallout from

Newsletter

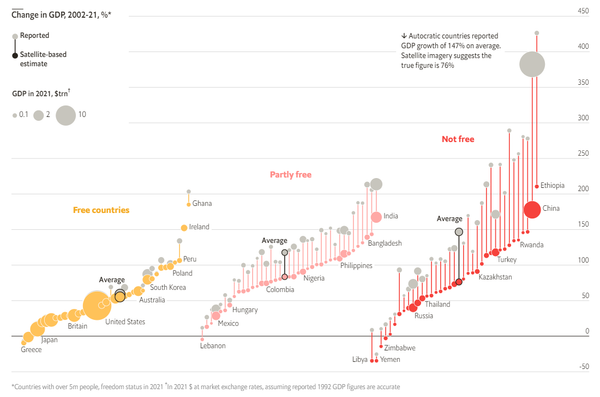

“If liberty means anything at all it means the right to tell people what they do not want to hear.” - George Orwell Governments will always be tempted to exaggerate how well things are going for their citizens. Most governments must face their electorate once every four or five years,

Newsletter

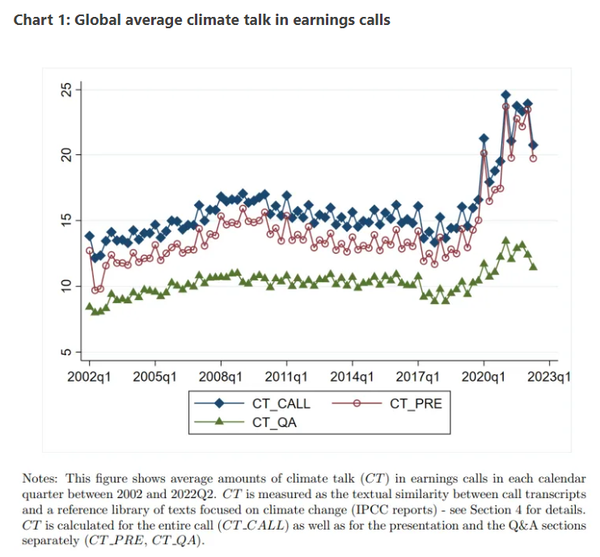

Carbon and climate change has become a big talking point during quarterly earnings calls. The calls are usually hosted by a publicly traded company after the publication of its earnings reports for a given period (typically quarterly). Investors, equity analysts, and business journalists listen in or comb the transcripts of