Newsletter

MAC curve steepening

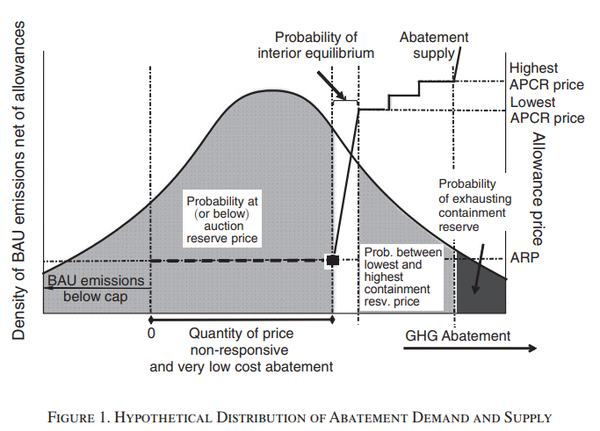

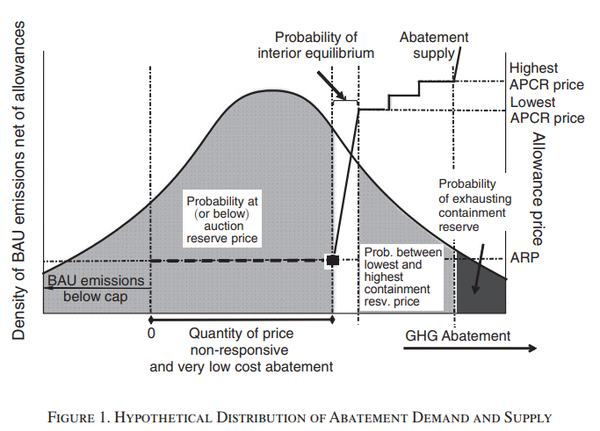

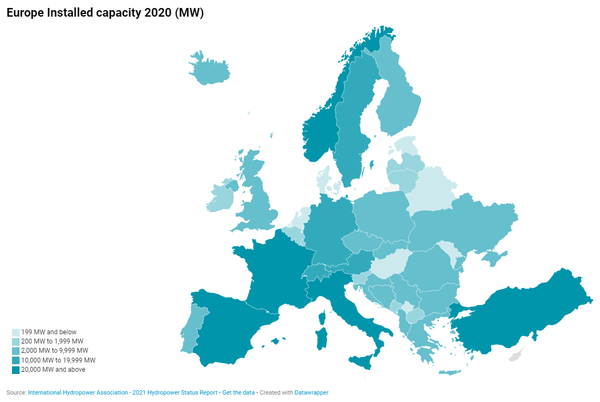

What California's mix of carbon policies means for price discovery

Newsletter

What California's mix of carbon policies means for price discovery

Newsletter

The EU must invest an extra €200bn over the next 5 years if it is to secure energy independence from Russia and accelerate the decarbonisation of the EU economy. That’s according to a leaked draft of the REpower EU package, due to be presented on Wednesday 18th May, and

Newsletter

Why are the Indonesian and Papua New Guinea carbon credit markets on hold?

Newsletter

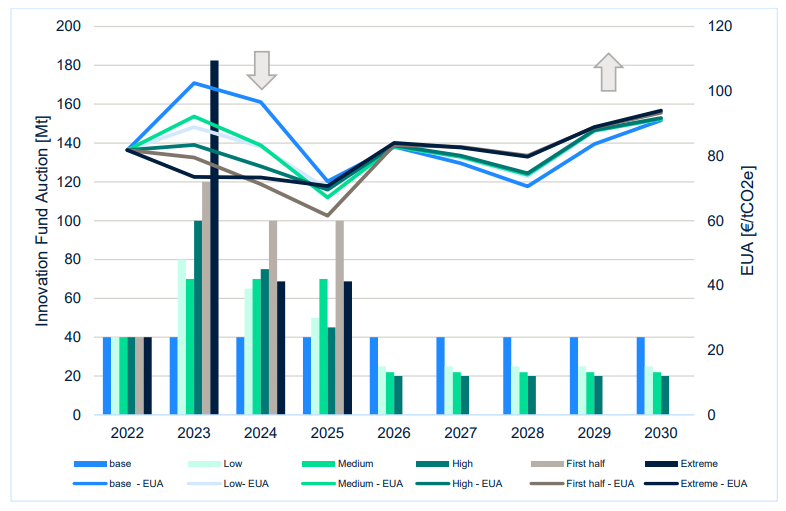

Why carbon market investors need to keep an eye on Europe's drought

Newsletter

The lumpy, unpredictable nature of climate change and the transition towards zero carbon is likely to mean that inflation will be higher, and more volatile in the future. Much of this inflationary pressure relates to the impact that climate shocks have on the supply of essential commodities, especially agricultural and

Newsletter

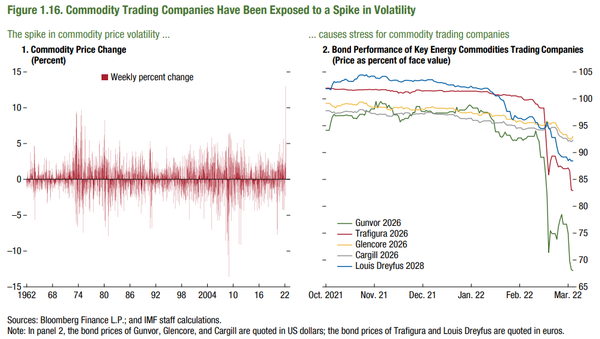

Commodity trading houses have always been prone to liquidity mismatches during times of stress. Physical commodities may take months to transport to the end user, while margin calls on futures contracts must be met immediately. Russia’s invasion of Ukraine sparked the latest episode in a long history of managing

Newsletter

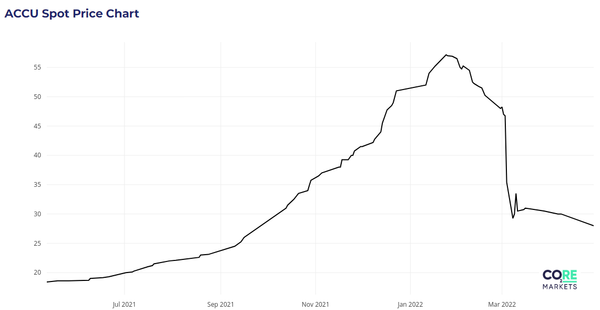

What can investors learn from the collapse of the Australian carbon market?

Newsletter

The carbon price is the currency of decarbonisation. A strong carbon price is a signal that investors, businesspeople and citizens trust their government’s commitment to combat climate change. In the same way that trust in individual currencies supports investment, innovation and trade, trust in an economy’s carbon market

Newsletter

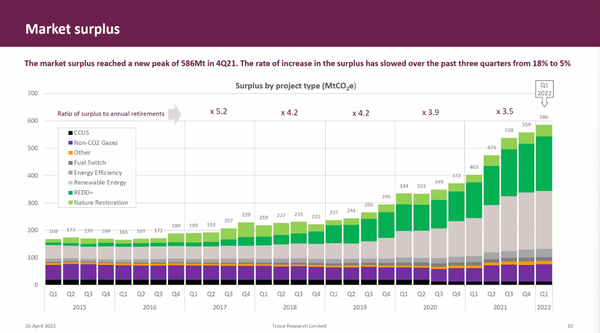

The voluntary carbon market (VCM) is expected to increase 9-fold by 2030 to around 900 MtCO2e. But what’s the best way to play the VCM market opportunity? One option is to invest in the project developers, leveraging the growth in carbon tonnages and the potential increase in the price

Newsletter

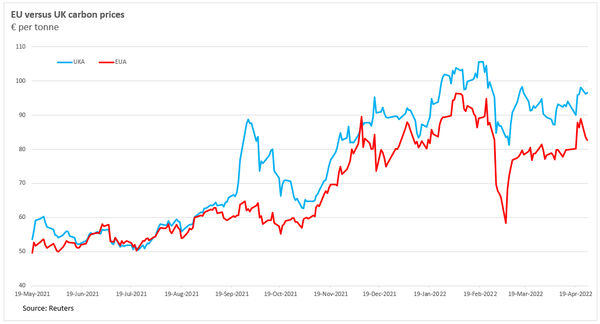

The UK carbon market continues to trade at a hefty premium compared with the EU. Four factors are contributing to the high price of carbon in the UK: lower natural gas prices versus the continent, greater political support for businesses suffering from high energy costs, increased speculative interest from hedge

Newsletter

How carbon and natural capital investors are driving demand for land

Newsletter

The price of carbon allowances in California has increased by around one-third since early March, rebounding from the Ukraine-Russia induced sell-off to trade near $30-32 per tonne. So where do we go from here? Here are the 5 factors you need to pay attention to: rainfall levels and the potential