Newsletter

EU vote to extend 24% MSR withdrawal rate signals commitment to carbon market

Attention now focuses on upcoming TNAC estimate

Newsletter

Attention now focuses on upcoming TNAC estimate

Newsletter

The carbon trade you've probably never heard of

Newsletter

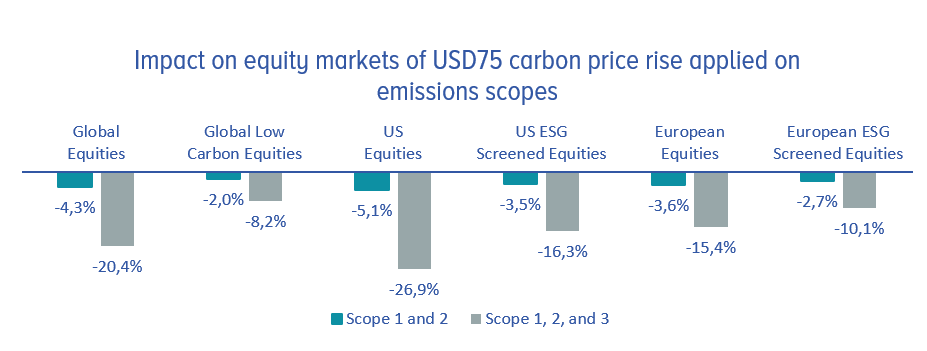

Financial markets have typically worked on the assumption that climate policy would be gradually tightened over a period of several years, if not decades. This is known as the “slow policy ramp”. Too high a carbon price at the outset for example, many reason, will be politically untenable. Instead the

Newsletter

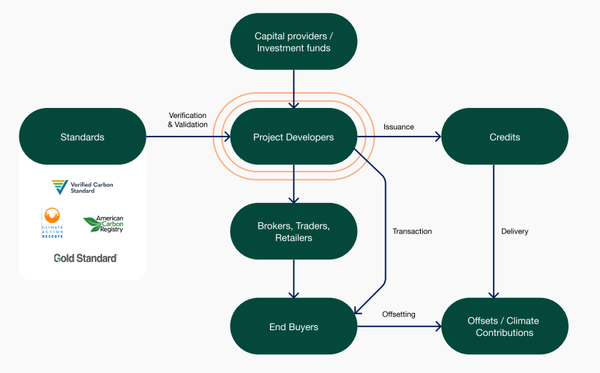

Japan’s top business newspaper, The Nikkei published an article this week detailing the results of its investigation into ‘carbon neutral’ LNG. The article suggests that many of the claims around carbon neutral LNG are false, with offsets often originating from carbon projects where environmental benefits have been significantly inflated.

Newsletter

The voluntary carbon market (VCM) cannot be measured simply looking at the current value of various carbon credits. The VCM is a growth sector where everything is up for grabs. It is an unregulated sector where there are no hard and fast rules as to how things must be done.

Newsletter

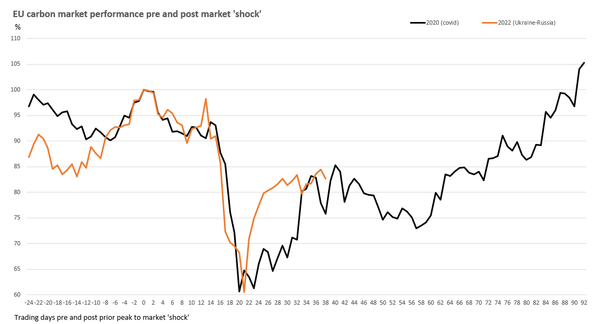

“History doesn’t repeat itself but it often rhymes” Financial markets often exhibit similar patterns in the event of a significant shock to market confidence - anticipating the potential effects, the impact and then the recovery. Even if the cause and effects vary between market shocks how prices behave can

Newsletter

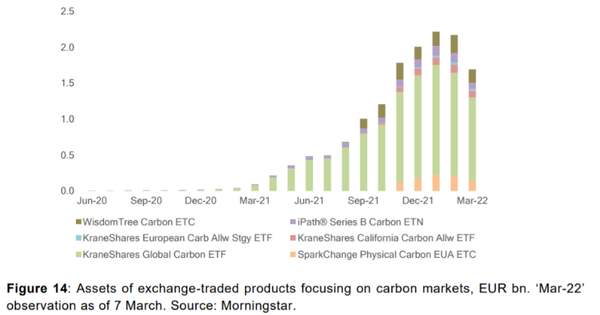

Up until recently, an investor wishing to gain exposure to the EU carbon market had to invest in an exchange traded futures product. That changed in November last year when the first physical carbon allowance investment product launched. Unlike futures based products, investing in the physical allowance is not without

Newsletter

"There are no taboos in this situation" EU ETS emissions are estimated to have increased by 8.7% in 2021, according to a recent poll of analysts by Refinitiv. Exceptionally high natural gas prices resulted in generators switching to thermal coal, significantly increasing the carbon intensity of power

Newsletter

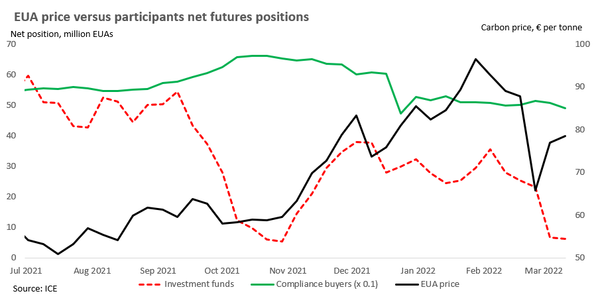

“If everyone is thinking the same thing, someone is not thinking.” - General George Patton, U.S. Army Futures markets are not simply full of speculators trying to anticipate what other speculators are going to do, although it might feel like that sometimes. Commodity futures markets involve a vast array

Newsletter

Carbon prices on the Regional Greenhouse Gas Initiative (RGGI) fell by almost 10% yesterday after a report released by Virginia Governor Glenn Youngkin criticised the emissions trading scheme for being ineffective and forcing consumers to pay more for their electricity. However, what appears to have unnerved the market and led

Newsletter

Hedging by utilities is one of the principle drivers of carbon allowance demand, and in turn carbon market price discovery. Utilities are one of the most active participants in the EUA spot and futures markets, balancing both their current and expected future carbon risk. However, over the next few years

Newsletter

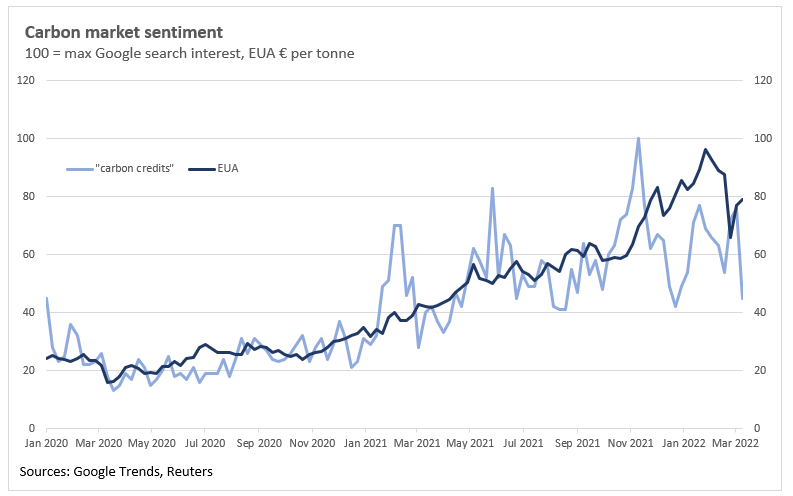

Every so often its worth stepping back and checking in on the prevailing sentiment underpinning an asset class. Carbon markets are no different, especially now that there is greater degree of retail investor participation. There are a few ways of looking at this: Google search interest for related terms, whether