Newsletter

Pulling the rug out from 'Down Under'

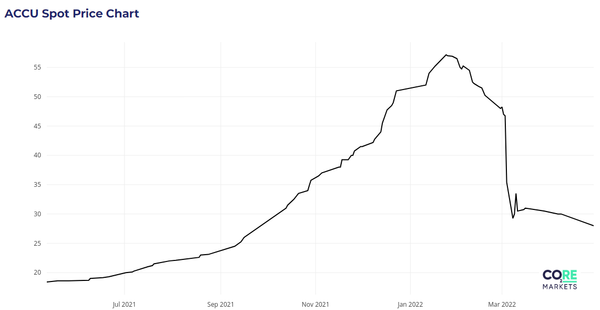

What can investors learn from the collapse of the Australian carbon market?

Newsletter

What can investors learn from the collapse of the Australian carbon market?

Newsletter

The carbon price is the currency of decarbonisation. A strong carbon price is a signal that investors, businesspeople and citizens trust their government’s commitment to combat climate change. In the same way that trust in individual currencies supports investment, innovation and trade, trust in an economy’s carbon market

Newsletter

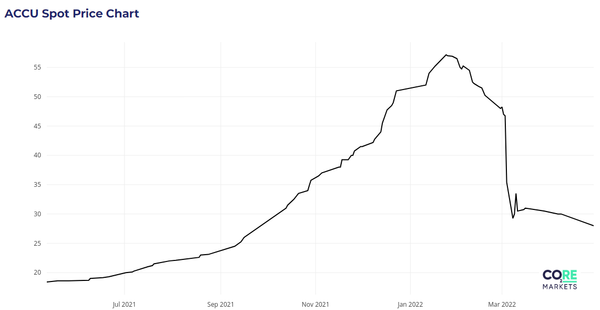

The voluntary carbon market (VCM) is expected to increase 9-fold by 2030 to around 900 MtCO2e. But what’s the best way to play the VCM market opportunity? One option is to invest in the project developers, leveraging the growth in carbon tonnages and the potential increase in the price

Newsletter

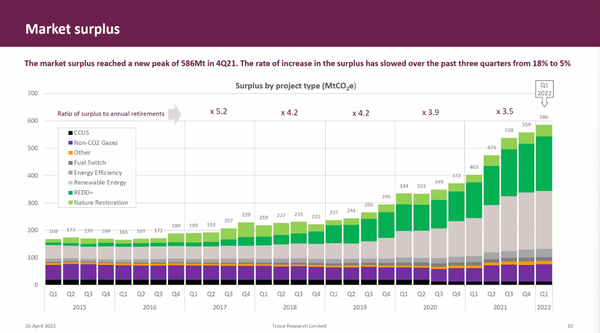

The UK carbon market continues to trade at a hefty premium compared with the EU. Four factors are contributing to the high price of carbon in the UK: lower natural gas prices versus the continent, greater political support for businesses suffering from high energy costs, increased speculative interest from hedge

Newsletter

How carbon and natural capital investors are driving demand for land

Newsletter

The price of carbon allowances in California has increased by around one-third since early March, rebounding from the Ukraine-Russia induced sell-off to trade near $30-32 per tonne. So where do we go from here? Here are the 5 factors you need to pay attention to: rainfall levels and the potential

Newsletter

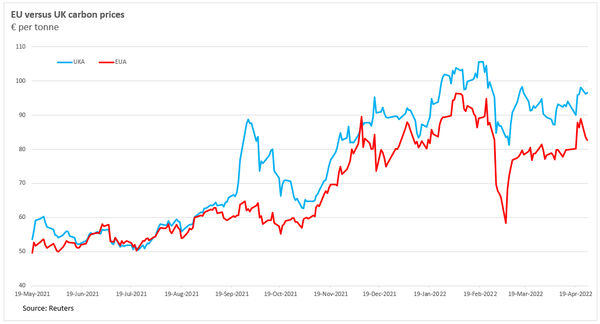

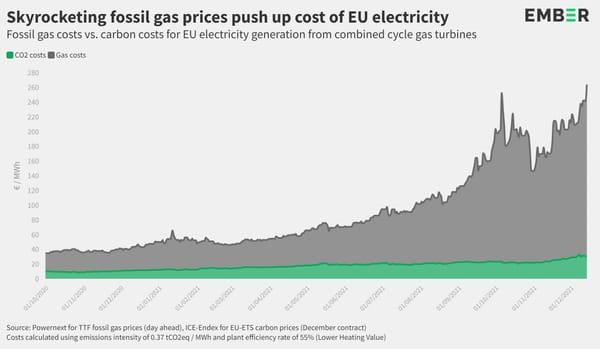

EU carbon prices rose 4-fold between late 2020 and early 2022 to almost €100 per tonne, only to then crash 40% in the aftermath of Russia’s invasion of Ukraine to less than €60 per tonne. Following its subsequent rebound, the price of carbon has settled in a narrow trading

Newsletter

Critics of the EU carbon market contend that Europe’s policymakers are fools for indulging in such virtue signalling at a time when society, especially the poorest, are hurting under intense inflationary pressures. Regular readers will know that revenue from auctioned EU carbon allowances (EUAs) can be redirected by member

Newsletter

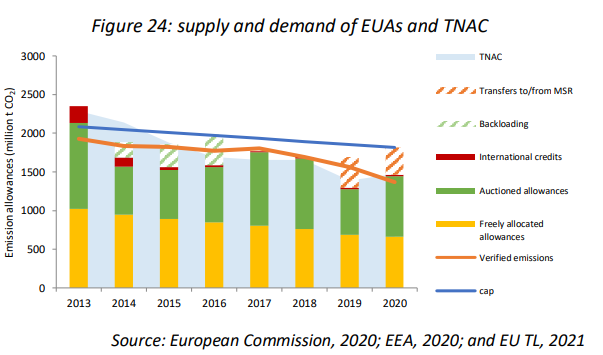

Commodity markets are typically interpreted through the lens of changes in supply and demand, and the impact on inventories in any particular year. Inventories of ‘consumable’ commodities (e.g. crude oil, wheat, etc.) typically only cover consumption demand for a few months. If there were no inventories at all, supply

Newsletter

Carbon investors are increasingly looking at other compliance markets outside of the EU. The attraction for many is that as these markets are reformed then the price of emission allowances could stage a similar upward price trajectory as the EU experienced, particularly in the period since 2018 when the price

Newsletter

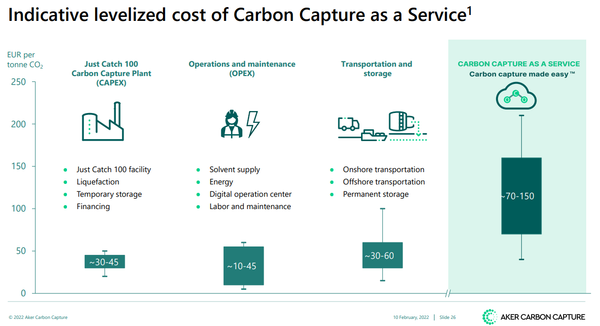

Carbon capture, use and storage (CCUS) involves catching concentrated industrial emissions at their source, preventing them from entering the atmosphere. CCUS has been seen as controversial, particularly by environmentalists who see it as a get-out-of-jail-free-card enabling fossil fuel producers and consumers to carry on extracting coal, gas and oil and

Newsletter

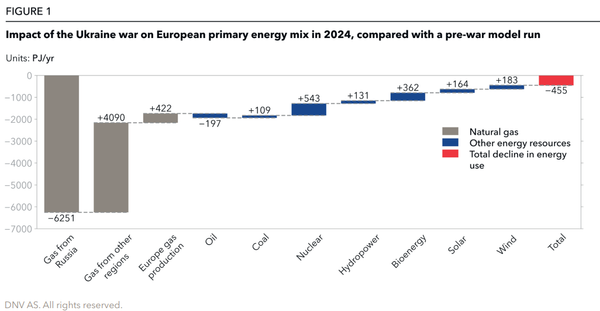

Europe’s pivot towards energy security, sparked by Russia’s invasion of Ukraine, will not come at the cost of decarbonisation. That’s the message from a recently published report by a risk management advisory firm. Gauging the often conflicting effects of higher energy prices, fuel generation switches and investment