Newsletter

Playing with fire

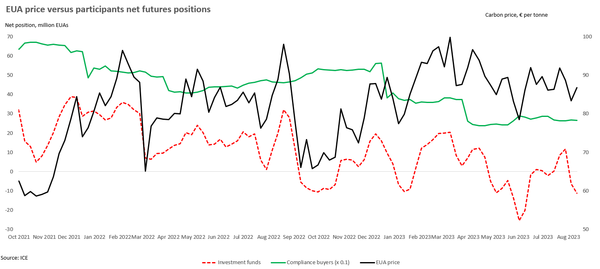

The latest COT report (w/e Friday 11th August) shows that investment funds increased their short position by 4.9 million EUAs verus week earlier to 11.3 million EUAs. It’s dangerous to be too heavily exposed to lower carbon prices this time of year. The risk of a